Zinger Key Points

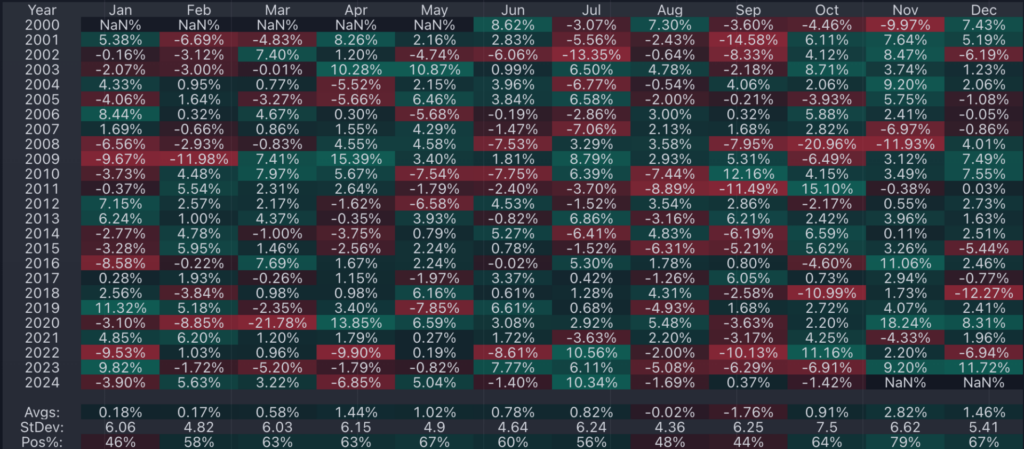

- November is historically the best month for small caps, with the Russell 2000 delivering gains 79% of the time since 2000.

- December follows as the second-best month for small caps, with the Russell 2000 averaging a 1.46% gain and posting positive returns in 67% o

- Get real-time earnings alerts before the market moves and access expert analysis that uncovers hidden opportunities in the post-earnings chaos.

U.S. small-cap stocks are delivering a standout performance in November, aligning with a well-established seasonal trend that often paves the way for a strong December.

Historically, small caps tend to excel in the final two months of the year, with November’s impressive gains often rolling into December as part of the so-called “Santa Rally.”

The Russell 2000 index, the leading benchmark for small-cap equities, has climbed an impressive 8% this November, on track for the second-best monthly performance of the year.

See Also: Google, Anthropic Deal In Jeopardy As Regulators Look To Break Up Search Monopoly

Data spanning more than two decades shows that November delivered the highest average returns for small-cap stocks.

From the year 2000 onward, the iShares Russell 2000 ETF IWM, has averaged a 2.6% gain in November, marking it as the strongest month of the year.

What's even more striking is the reliability of this trend—79% of the time, the month ends with small-cap stocks in the green.

The Russell 2000 has ended November in negative territory only four times:

- A decline of 9.97% in 2000,

- 6.97% in 2007,

- 11.93% in 2008, and

- 4.33% in 2021.

In all other years, small-cap stocks have delivered gains during the month. The strongest rally occurred in November 2020, when the Russell soared 18.24% buoyed by the discovery of the Covid-19 vaccine.

Yet, history suggests this isn't the time to cash out just yet. Investors tempted to take profits after November's gains might reconsider, as December historically ranks as the second-best month for small caps.

On average, the Russell 2000 rose 1.46% in December, with 67% of years showing positive performance. The combination of these two months often gives small-cap investors a powerful year-end boost.

Russell 2000 Monthly Seasonality: November And December Show The Highest Average Gains

Why Are Small Caps Outperforming in November 2024?

As of late November, the Russell 2000's 8% rally far surpasses the 4% rise of the S&P 500, tracked by the SPDR S&P 500 ETF Trust SPY. This outperformance is being driven by three major catalysts:

1. Federal Reserve Rate Cuts

The Federal Reserve has shifted into rate-cut mode, lowering rates by 25 basis points in November following a 50-basis-point reduction in September. Policymakers have signaled that further cuts are likely, albeit at a slower pace, as long as inflation continues to decelerate.

Lower interest rates disproportionately benefit small-cap companies, which rely more heavily on bank financing than their larger-cap counterparts. With borrowing costs falling, small businesses are better positioned to invest, grow, and improve profitability, giving them a significant tailwind compared to multinational firms.

2. Political Tailwinds From 2024 Elections

The outcome of the 2024 U.S. elections — a Republican trifecta (presidency, Senate and House of Representatives) — has fueled optimism among small-cap investors expecting the Trump administration to roll back regulations.

Additionally, the potential reintroduction of trade tariffs could act as a buffer for small-cap businesses by reducing competition from international firms facing higher regulatory or import costs. Financial services and industrial stocks, heavily represented in small-cap indices, have been among the top beneficiaries of this shift.

3. Economic Resilience

The U.S. economy is showing remarkable resilience by delivering strong GDP growth rates. The Atlanta Fed's GDPNow estimate pegs fourth-quarter real GDP growth at 2.6%, following robust gains of 3.0% and 2.8% in the second and third quarters, respectively.

The labor market, a key indicator of economic health, also remains resilient. Despite disruptions from strikes and hurricanes affecting October payrolls data, jobless claims have fallen to their lowest levels in seven months in mid-November, indicating a tight labor market and sustained consumer confidence. These factors collectively underpin the performance of small-cap stocks, which are often more sensitive to domestic economic trends.

What's Next For Small Caps?

With November's gains already in the books, historical patterns suggest that small caps could keep their momentum into December. Whether fueled by seasonal trends, macroeconomic tailwinds, or political optimism, small-cap stocks are positioning themselves as a standout opportunity for year-end trading.

Now Read:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.