Semtech Corporation SMTC reported better-than-expected third-quarter financial results and issued fourth-quarter guidance with its midpoint above estimates.

Semtech reported quarterly earnings of 26 cents per share which beat the analyst consensus estimate of 23 cents per share. The company reported quarterly sales of $236.80 million which beat the analyst consensus estimate of $232.06 million.

“We are very pleased to report broad-based growth across each of our end markets, and particularly in data center, where we project AI-driven product demand to be a long-term and transformational growth engine for Semtech. Our results validate that our customers and target markets are moving toward us and highlight the effectiveness of our initiatives to drive market share gain and SAM expansion,” said Hong Hou, Semtech’s president and chief executive officer. “I believe we have achieved multi-generational roadmap alignment with customers and aspire to become the partner of choice for key technical and product solutions we provide.”

Semtech shares gained 5% to close at $53.44 on Monday.

These analysts made changes to their price targets on Semtech following earnings announcement.

- Needham analyst Quinn Bolton reiterated Semtech with a Buy and raised the price target from $50 to $70.

- Northland Capital Markets analyst Gus Richard maintained the stock with an Outperform and raised the price target from $46 to $60.

- Piper Sandler analyst Harsh Kumar reiterated Semtech with an Overweight and raised the price target from $60 to $75.

- Stifel analyst Tore Svanberg maintained the stock with a Buy and boosted the price target from $58 to $65.

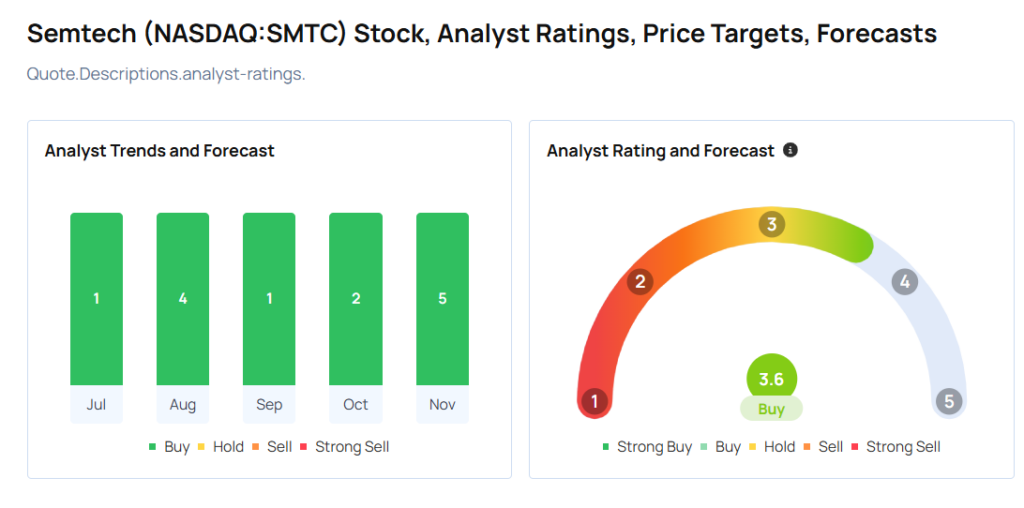

Considering buying SMTC stock? Here’s what analysts think:

Read This Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.