On Sunday, ARK Invest‘s Cathie Wood shed light on the potential repercussions of a possible fallout between President-elect Donald Trump and Elon Musk on Musk’s companies, Tesla Inc. TSLA and SpaceX.

What Happened: During a recent appearance on CNN’s Inside Politics Sunday, Wood was asked about the implications of a potential strain in the Musk-Trump relationship. She acknowledged the strong personalities of both individuals and the potential risks associated with such a dynamic.

However, Wood also highlighted Musk and Trump’s shared vision of advancing technology, particularly in the fields of transportation and healthcare.

Wood stated, “Well I think that if you look at Elon Musk’s companies, what they’re doing is taking us into this new age, whether it’s Tesla with autonomous mobility and robotaxis or SpaceX, really getting us to the moon again and then to Mars. I think these are things that President Trump wants.”

She further emphasized that both Trump and Musk possess strong personalities, a trait that has played a significant role in their respective successes. Wood expressed her belief that both individuals are well aware of the risks that come with such dominant personalities.

“They have — they’re going to keep their eye on the prize, which is really trying to use these technologies to transform not only transportation but I think in particular healthcare,” Wood concluded in the interview.

Why It Matters: Wood’s comments come in the wake of her recent analysis of the potential impact of a second Trump administration on various sectors. In a webinar, she expressed optimism about the future of the market under Trump, predicting a thriving IPO market that would provide numerous opportunities for portfolio diversification and liquidity events.

Wood also suggested that a Trump administration could bring much-needed regulatory clarity to the fintech sector, particularly in the realm of digital assets. She highlighted the potential for a more focused approach to the digital asset revolution, led by Bitcoin BTC/USD if current SEC Chairman Gary Gensler were to step down.

Beyond this, Wood has also been vocal about the potential benefits of Musk’s leadership in the government sector. She endorsed the Department of Government Efficiency (DOGE) under Musk’s leadership, advocating for stricter government spending controls and constitutional reforms to limit federal expenditures.

Despite this, Wood’s firm, ARK Invest, has been making strategic adjustments to its portfolio, including significant trades involving Tesla. The firm sold $18 million worth of Tesla shares last week across multiple ETFs, reflecting a shift in its trading strategy amid market changes.

Price Action: Tesla stock closed 3.7% higher on Friday at $345.16. It is up 39% year-to-date, according to Benzinga Pro data.

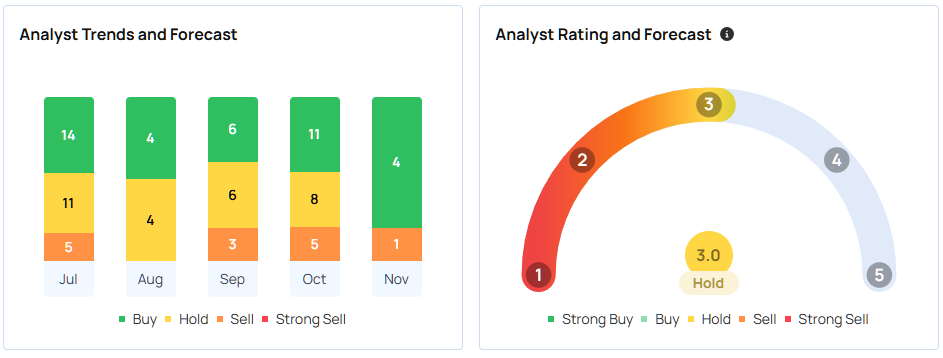

The three most recent analyst ratings are from UBS, Wedbush, and RBC Capital, with an average price target of $313, implying a downside of 9.4%, according to Benzinga Pro data.

Read Next:

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image Via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.