Zinger Key Points

- Synopsys is ready to divest an Ansys unit on top of one of its own to win EU approval for its $35 billion acquisition.

- The European Commission is awaiting feedback from rivals and customers on Synopsys' proposal.

- Join Nic Chahine live on Wednesday, March 19, at 6 PM ET for a step-by-step breakdown of how to to capitalize on post-Fed volatility and manage risk in this fast-moving market. Register for this free strategy session today.

Synopsys Inc. SNPS, an American electronic design automation company, is preparing to divest an Ansys Inc. ANSS unit, along with one of its own, to secure EU approval for its $35 billion acquisition, according to sources cited by Reuters. Ansys specializes in software development for autonomous vehicle sensor simulations, including lidar, radar, and camera design.

The European Commission is awaiting feedback from rivals and customers on Synopsys’ proposal.

Also Read: Goldman Sachs Initiates Similarweb Coverage, Product Upgrades Inspire Bullish Take

Responses are due by Dec.16.

Synopsys agreed to sell its optical design tool maker, Optical Solutions Group, to design and emulation company Keysight Technologies Inc KEYS.

It has now also offered to divest Ansys PowerArtist, including its research, development, distribution, licensing, selling, and marketing. PowerArtist is a tool for analyzing and reducing power to enable power-efficient design.

Synopsys expects the Ansys deal to close in the first half of 2025, Reuters reports.

Synopsys did not offer any behavioral remedies for its business practices, implying no regulatory objection regarding interoperability and product bundling.

In January 2024, Synopsys agreed to acquire Ansys for $35 billion through $19 billion in cash and $16 billion in debt.

In May, Synopsys forged a deal to sell its Software Integrity Group business to Clearlake Capital Group and Francisco Partners for about $2.1 billion.

In October, the UK’s antitrust watchdog launched an inquiry into the Synopsys-Ansys deal, citing antitrust concerns.

Synopsys held $4.05 billion in cash and equivalents as of Oct. 31, 2024. It expects first-quarter revenue of $1.435 billion-$1.465 billion, below the consensus estimates of $1.643 billion, and adjusted EPS of $2.77-$2.82 below the forecast of $3.53.

Recent mergers, acquisitions, and investments by Big Tech giants have attracted global antitrust scrutiny. The EU is reviewing Nvidia Corp‘s Run:ai deal over possible stifling of competition in the AI space.

The Federal Trade Commission (FTC) is examining investments by Big Tech giants, including Microsoft Corp, Amazon.com Inc and Google parent Alphabet Inc into AI startups.

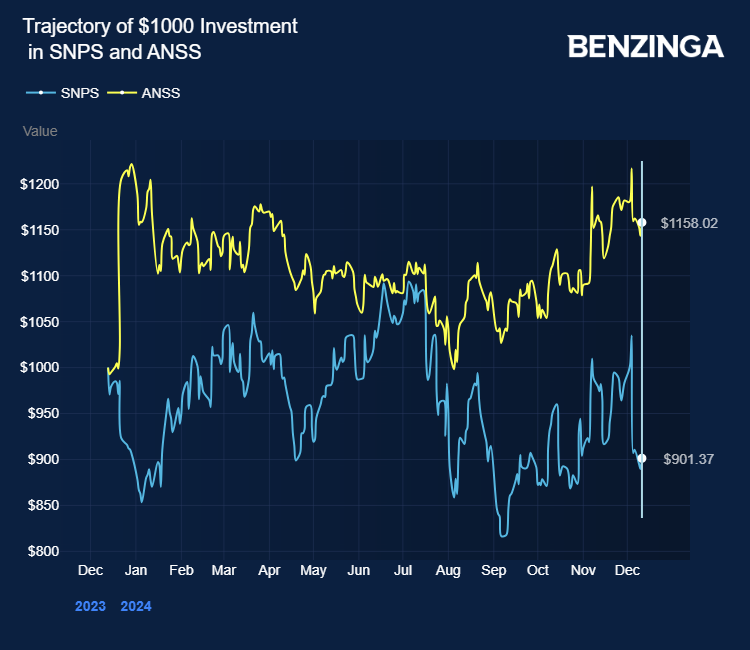

Price Actions: ANSS stock closed higher by 1.27% at $344.00 at Wednesday. SNPS closed higher by 1.33%.

Also Read:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.