The Santa Claus Rally, a typical year-end market surge, has seemingly failed to materialize this year, with stocks experiencing a recent downturn. However, this analyst expects the S&P 500 index to hit 7,000 points in the first half of 2025.

What Happened: According to Fundstrat Insights, Tom Lee, the head of research at Fundstrat attributed this decline to profit-taking and investor uncertainty surrounding the Federal Reserve’s future interest rate policies. However, he emphasizes that the positive market outlook for 2025 remains largely unchanged.

According to Lee, even if the S&P 500 closes the year at 5,900, it doesn’t diminish the significant potential for growth in 2025.

Looking ahead to next year, Lee said that he will closely monitor the CEO confidence index and the ISM manufacturing data for signs of economic expansion. He predicts that the S&P 500 could potentially reach 7,000 in the first half of 2025, representing substantial upside from current levels.

Louis Navellier from Navellier & Associates also said in his note that “It certainly appears to be a bit of profit-taking.”

According to Ed Yardeni of Yardeni Research there are multiple reasons for missing the Santa Rally. “From a sentiment perspective, there have been too many bulls. From a technical perspective, breadth has been narrowing again as a few LargeCap momentum stocks continue to outperform.”

“From a fundamental perspective, while earnings growth should remain bullish, the Fed may be done easing monetary policy for a while at the same time as the outlook for fiscal policy under Trump 2.0 is uncertain. From a valuation perspective, forward P/Es are stretched,” he added.

Why It Matters: Ryan Detrick, the chief market strategist at Carson Research, in an earlier X post had highlighted that no other seven-day period except the last seven days of the year is more likely to be higher. This period of ‘Santa Rally’ has given positive returns at least 78.4% of the time.

Reinstalling confidence among investors Navellier added “Normally, we rally going into New Year’s, and we normally rally in the new year. So, if we don’t, it means we have to wait until the A team comes back, which will of course be after the New Year’s holiday.”

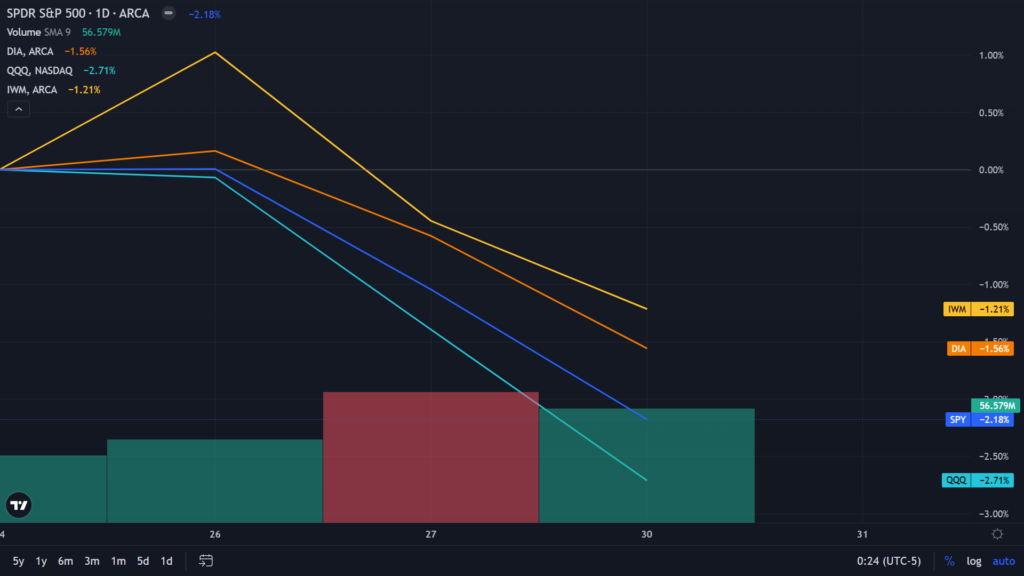

Price Action: According to Benzinga Pro data, the exchange-traded fund tracking the S&P 500, SPDR S&P 500 ETF Trust SPY was down 2.18% since Dec. 24. Whereas, Invesco QQQ Trust ETF QQQ tracking Nasdaq 100, was down 2.71%. The fund tracking Russell 2000 iShares Russell 2000 ETF IWM declined 1.21% and Dow Jones tracker SPDR Dow Jones Industrial Average ETF Trust DIA fell 1.56% in the same period.

| Index/ETF | YTD |

| S&P 500 Index | 24.54% |

| SPDR S&P 500 ETF Trust SPY | 24.45% |

| Nasdaq 100 | 28.13% |

| Invesco QQQ Trust ETF QQQ | 28.07% |

| Dow Jones | 12.88% |

| SPDR Dow Jones Industrial Average ETF Trust DIA | 12.91% |

| Rusell 2000 | 10.68% |

| iShares Russell 2000 ETF IWM | 10.61% |

Read Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.