PPG Industries, Inc. PPG reported worse-than-expected fourth-quarter adjusted EPS results and issued FY25 adjusted EPS guidance below estimates, after the closing bell on Thursday.

PPG reported quarterly earnings of $1.61 per share which missed the analyst consensus estimate of $1.65 per share.

Tim Knavish, PPG chairman and chief executive officer, commented on the year and quarter said, "Throughout 2024, we demonstrated resilience in a challenging macro environment by growing our adjusted EPS by 6%, improving aggregate segment margins and generating $1.4 billion in operating cash flow which we returned to shareholders. During the quarter, we repurchased approximately $250 million of stock, and about $750 million for the full year, which represented approximately 3% of our outstanding shares. Combined with our dividend, we have returned $1.4 billion to our shareholders throughout the year."

PPG said it sees adjusted EPS for FY25 will be in the range of $7.75-$8.05, versus market estimates of $8.68.

PPG shares fell 2.9% to trade at $112.07 on Monday.

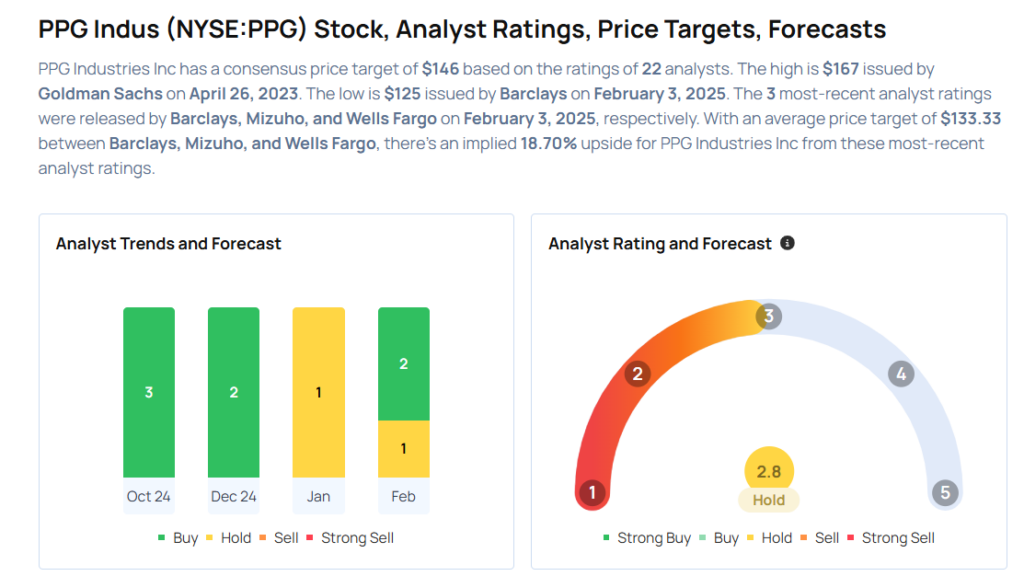

These analysts made changes to their price targets on PPG following earnings announcement.

- Wells Fargo analyst Michael Sison maintained PPG with an Overweight rating and lowered the price target from $150 to $135.

- Mizuho analyst John Roberts maintained the stock with an Outperform and lowered the price target from $150 to $140.

- Barclays analyst Michael Leithead maintained PPG with an Equal-Weight and cut the price target from $144 to $125.

Considering buying PPG stock? Here’s what analysts think:

Read This Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.