Universal Technical Institute, Inc. UTI reported better-than-expected first-quarter financial results and raised its FY25 guidance on Wednesday.

Universal Technical reported quarterly earnings of 40 cents per share which beat the analyst consensus estimate of 18 cents per share. The company reported quarterly sales of $201.43 million which beat the analyst consensus estimate of $193.94 million.

“In the first quarter of 2025, we continued to deliver on our growth, diversification, and optimization strategy, leading to outperformance across our key financial and operational metrics,” said Jerome Grant, CEO of Universal Technical Institute, Inc. “Both divisions experienced strong year-over-year growth, with consolidated revenue increasing 15%, average full-time active students growing 11%, and new student starts growing over 22%, while considerably increasing our bottom line. As a result, I’m proud to report that we are increasing our guidance ranges for fiscal 2025. We are fully aligned with our strategic growth objectives and are making steady progress toward achieving them throughout the year.

Universal Technical raised its FY2025 GAAP EPS guidance from $0.93-1.01 to $0.96-1.04 and increased its sales guidance from $800.00 million-815.00 million to $810.00 million-820.00 million.

Universal Technical Institute shares fell 1.9% to close at $28.39 on Wednesday.

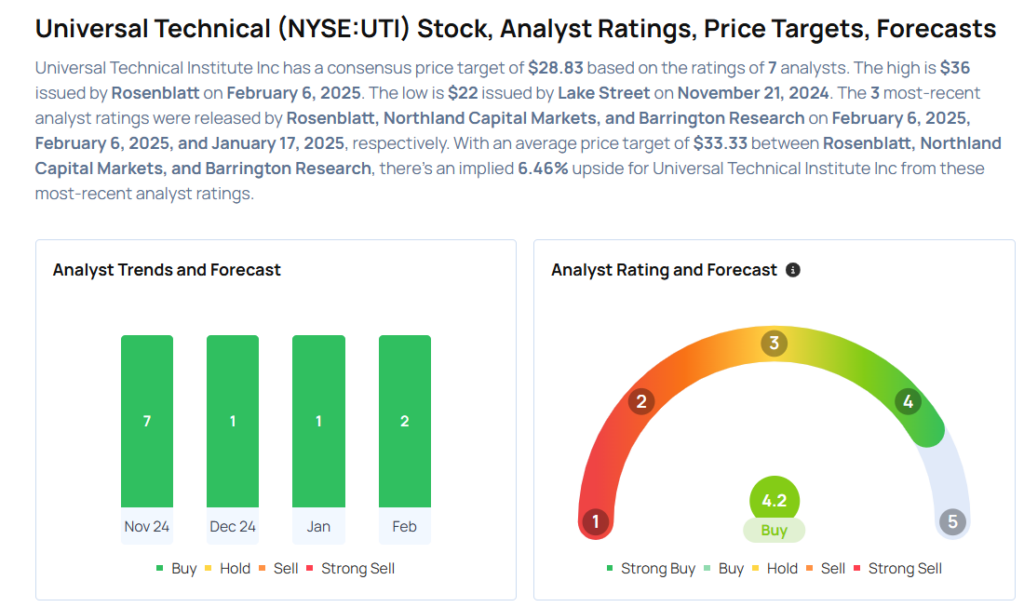

These analysts made changes to their price targets on Universal Technical Institute following earnings announcement.

- Northland Capital Markets analyst Mike Grondahl maintained Universal Technical with an Outperform rating and raised the price target from $30 to $34.

- Rosenblatt analyst Steve Frankel maintained the stock with a Buy and increased the price target from $30 to $36.

Considering buying UTI stock? Here’s what analysts think:

Read This Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.