Confluent, Inc. CFLT reported better-than-expected fourth-quarter financial results on Tuesday.

Confluent reported quarterly earnings of 9 cents per share which beat the analyst consensus estimate of 6 cents per share. The company reported quarterly sales of $261.22 million which beat the analyst consensus estimate of $256.83 million.

Confluent expects first-quarter revenue to be in the range of $253 million to $254 million. The company expects full-year 2025 revenue to be in the range of $1.117 billion to $1.121 billion.

Confluent announced a pair of partnership updates around the same time earnings were released. The company inked a new deal with Jio Platforms Limited to bring Confluent Cloud to Jio Cloud Services.

Confluent also announced an expanded partnership with Databricks to empower enterprises with real-time data for AI-driven decision-making through the combination of Confluent's complete Data Streaming Platform and Databricks' Data Intelligence Platform.

Confluent shares jumped 20.5% to trade at $36.33 on Wednesday.

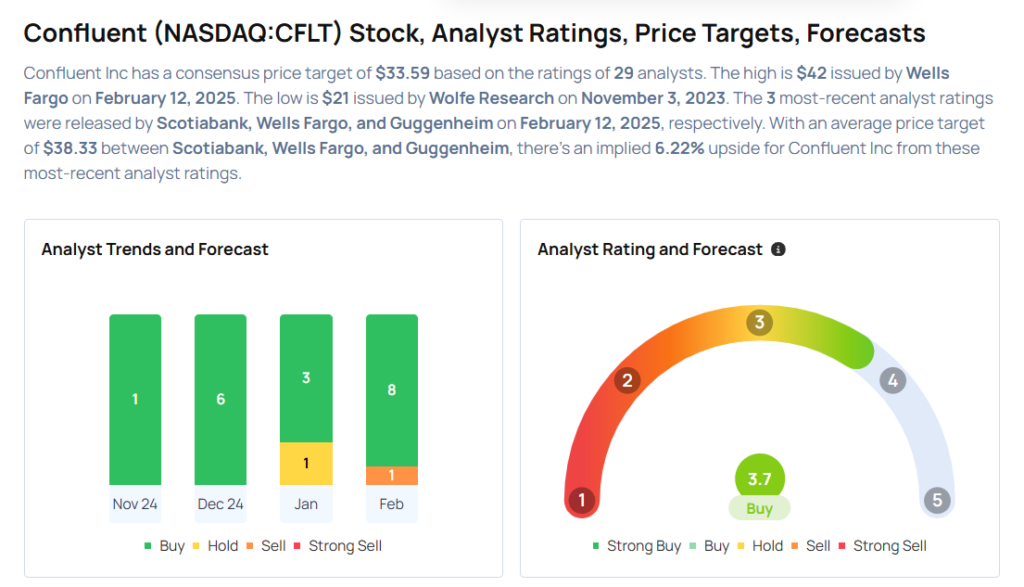

These analysts made changes to their price targets on Confluent following earnings announcement.

- B of A Securities analyst Brad Sills maintained Confluent with an Underperform and raised the price target from $26 to $31.

- Barclays analyst Raimo Lenschow maintained Confluent with an Overweight and raised the price target from $35 to $37..

- Needham analyst Mike Cikos maintained the stock with a Buy and raised the price target from $31 to $40.

- Stifel analyst Brad Reback maintained Confluent with a Buy and raised the price target from $37 to $40.

- Canaccord Genuity analyst Kingsley Crane maintained the stock with a Buy and boosted the price target from $34 to $38.

- Evercore ISI Group analyst Chirag Ved maintained Confluent with an Outperform and lifted the price target from $32 to $40.

- Piper Sandler analyst Rob Owens maintained the stock with an Overweight and raised the price target from $35 to $40.

- Guggenheim analyst Howard Ma maintained Confluent with a Buy and increased the price target from $35 to $38.

- Wells Fargo analyst Michael Turrin maintained the stock with an Overweight and raised the price target from $40 to $42.

- Scotiabank analyst Nick Altmann maintained the stock with a Sector Perform and raised the price target from $27 to $35.

Considering buying CFLT stock? Here’s what analysts think:

Read This Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.