Zinger Key Points

- Intel is pinning its hopes on a return to profitability by 2026, after highlighting progress on its advanced 18A process node.

- "I do believe that 18A is looking good in performance and power from a 'big die' standpoint," says analyst.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

Intel Corp. INTC shares have seen a significant surge, climbing 24.70% in the past five days and 20.59% since the company’s fourth-quarter earnings release on Jan. 3rd. This analyst has dismissed negative speculation surrounding the stock, pointing to strong fundamentals and saying that the recent jump “is an easy one.”

What Happened: Intel is pinning its hopes on a return to profitability by 2026, after highlighting progress on its advanced 18A process node during its recent earnings call. The 18A node, featured in upcoming launches like Panther Lake and Clearwater Forest, is Intel’s most cutting-edge semiconductor manufacturing technology.

Patrick Moorhead, the founder, CEO, and chief analyst at Moor Insights Strategy, in an X post, said “I do believe that 18A is looking good in performance and power from a ‘big die’ standpoint, and that yields for big die products are reasonable for this time in the cycle. A lot more work to be done, though.”

A ‘die’ is a semiconductor chip and in the context of Intel, a ‘big die’ refers to larger processor chips.

Apart from this Moorhead also highlighted that Intel stock was trading “below book value,” despite having “a ton of assets”. A stock is considered undervalued if its market price trades below the book value per share.

Furthermore, the analyst said that President Donald Trump‘s admin could be pushing chipmakers like Nvidia Corporation NVDA, Broadcom Inc. AVGO, Advanced Micro Devices Inc. AMD, and Marvell Technology Inc. MRVL to explore Intel’s foundry.

Why It Matters: Rumors suggest that the U.S. government could be pushing Intel into a joint venture with TSMC to boost domestic chip manufacturing, according to Baird analyst Tristan Gerra.

TSMC would reportedly send engineers to Intel’s 3nm and 2nm plants, potentially leading to a spin-off fab unit co-owned and operated by TSMC. The new venture could be eligible for CHIPS Act funding, designed to support the American semiconductor industry.

“While there is no confirmation and potential completion of this project could be lengthy, we think this move makes sense…” Gerra noted.

Intel’s interim co-CEO, Michelle Holthaus during its earnings call held on Jan. 30 said, “Looking ahead to the rest of the year, we will strengthen our client road map with the launch of Panther Lake, our lead product on Intel 18A in the second half of 2025.”

He also expressed excitement about its progress in performance and yields, anticipating production in the second half of 2025 and highlighting the benefits of its design and process technology.

“We are also making good progress on Clearwater Forest, our first Intel 18A server product that we plan to launch in the first half of next year. All of this provides a strong foundation on which to build as we execute,” Holthaus added.

Price Action: Intel shares gained 7.34% on Thursday, reaching $24.13 per share, and advanced 0.91% after-hours.

The exchange-traded fund tracking the Nasdaq 100 index, Invesco QQQ Trust, Series 1 QQQ rose 1.44% on Thursday. INTC has risen 19.34% year-to-date, whereas it plunged 45.39% over the last year.

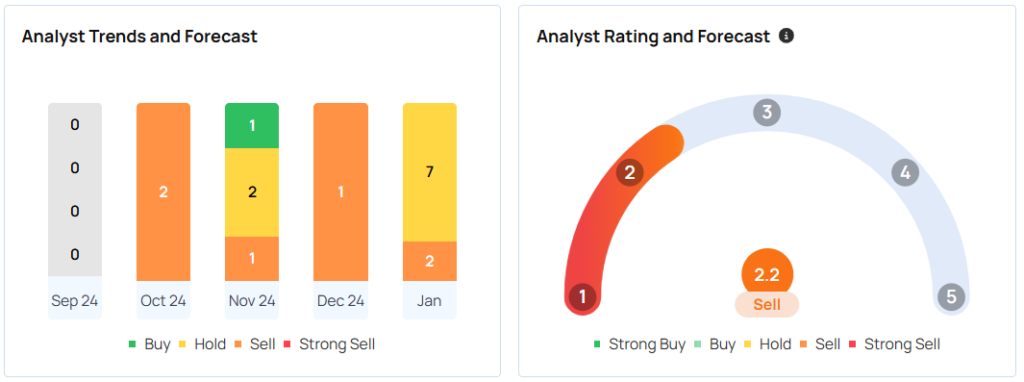

The average price target among 33 analysts tracked by Benzinga is $27.19 with a ‘sell’ rating. The estimates range from $20 to $66 apiece. Recent ratings from JP Morgan, Stifel, and Truist Securities suggest a $21.67 target, implying a potential downside of 11.02%.

Read Next:

Image via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.