American International Group, Inc. AIG posted better-than-expected earnings for its fourth quarter, after the closing bell on Tuesday.

The company posted adjusted earnings of $1.30 per share, beating market estimates of $1.23 per share. General Insurance net premiums written came in at $6.1 billion, an increase of 6% year-over-year on a reported basis.

“2024 was an outstanding year of accomplishments for AIG in which we successfully executed multiple complex strategic and operational priorities, delivered outstanding financial results and created exceptional value for our clients and stakeholders. We strengthened the company’s capital structure, improved our financial performance, and achieved a historic milestone with the deconsolidation of Corebridge Financial, which enabled us to organize our business into three distinct operating segments,” said Peter Zaffino, AIG Chairman & Chief Executive Officer.

AIG shares fell 0.6% to close at $76.40 on Thursday.

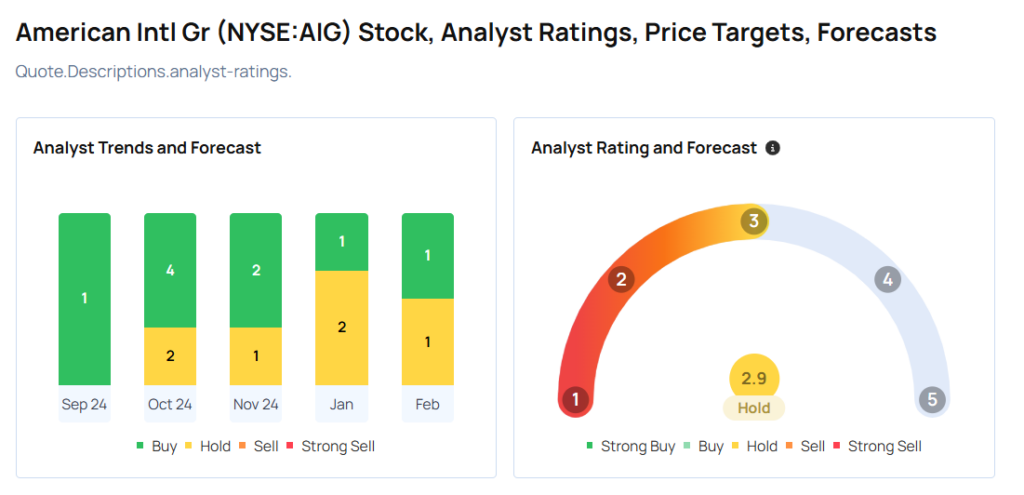

These analysts made changes to their price targets on AIG following earnings announcement.

- Keefe, Bruyette & Woods analyst Meyer Shields maintained American Intl with an Outperform and raised the price target from $87 to $90.

- Morgan Stanley analyst Michael Phillips maintained the stock with an Equal-Weight and raised the price target from $75 to $76.

Considering buying AIG stock? Here’s what analysts think:

Read This Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.