GoDaddy Inc. GDDY reported weaker-than-expected earnings for its fourth quarter on Thursday.

The company posted quarterly earnings of $1.36 per share which missed the analyst consensus estimate of $1.43 per share. The company reported quarterly sales of $1.192 billion which beat the analyst consensus estimate of $1.179 billion.

“GoDaddy demonstrated strong operational execution and financial performance in 2024, making significant progress across our key strategic initiatives,” said GoDaddy CEO Aman Bhutani. “Looking ahead to 2025, we are excited to further innovate around GoDaddy Airo, enhance our integrated technology platform and create even more value for our customers.”

GoDaddy said it sees first-quarter revenue of $1.175 billion to $1.195 billion versus estimates of $1.186 billion.

GoDaddy shares gained 2.4% to close at $212.54 on Thursday.

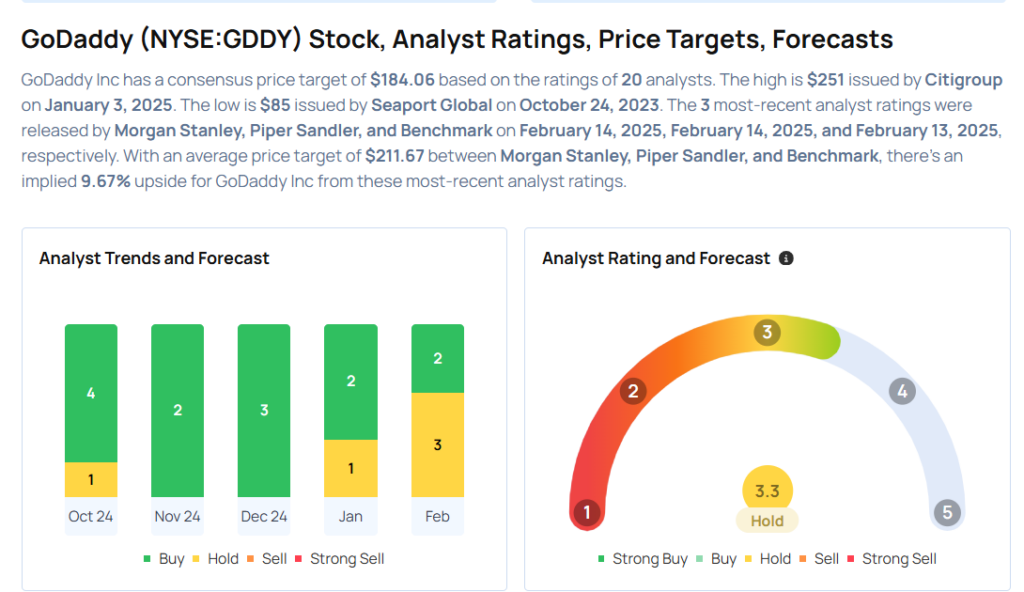

These analysts made changes to their price targets on GoDaddy following earnings announcement.

- Piper Sandler analyst Clarke Jeffries maintained GoDaddy with a Neutral and raised the price target from $176 to $177.

- Morgan Stanley analyst Elizabeth Elliott maintained GoDaddy with an Equal-Weight and raised the price target from $227 to $228.

Considering buying GDDY stock? Here’s what analysts think:

Read This Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.