Zinger Key Points

- Kohl’s expects sales to decline by 5% to 7% in fiscal 2025, due in part to “constrained” shoppers.

- Kohl’s CEO also notes consumers are seeking more value in their purchases.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Kohl's Corp. KSS on Tuesday joined other major retailers in painting a grim picture of the state of the American consumer. In fact, Kohl's said it expects sales to decline by 5% to 7% in fiscal 2025, due in part to "constrained" shoppers.

What To Know: U.S. consumers have faced steady inflation following the pandemic and are trading down across categories including clothing and discretionary items due to high prices. Low-income households are particularly affected, with many opting for cheaper brands or smaller quantities.

Read Next: Uncertainty Rocks The Trump Trade: How ‘MAGA Seven’ Stocks Look Now

Kohl's CEO Ashley Buchanan said on the company's earnings call that much of the retailer's customer base is under pressure from recent increases in rent, housing and groceries costs.

"If you're making less than 50 [thousand], that consumer is pretty constrained from a discretionary standpoint. If you're making less than 100 [thousand], it's also pretty challenging. And you see that very clearly in numbers," Buchanan told analysts.

The Kohl's CEO also noted consumers are seeking more value in their purchases, "and that will probably expand probably across income cohorts over the next probably three or four months," Buchanan said.

Other retailers like Best Buy Co. BBY and Target Corp. TGT spoke to increased price sensitivity and weaker consumer confidence in their 2025 outlooks last week.

“The giant wild card here, obviously, is how the consumers are going to react to the price increases, in light of a lot of price increases potentially throughout the year and a general consumer confidence that is showing little signs of weakness at the moment,” Best Buy CFO Matt Bilunas said on the company's earnings call.

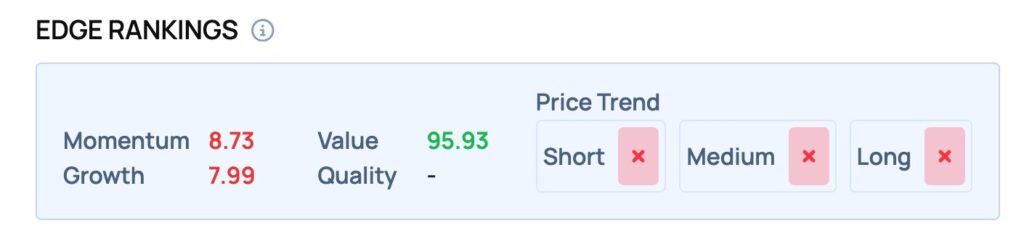

KSS Price Action: Kohl's shares took a big hit following the company's fourth-quarter earnings report on Tuesday, but the stock achieved a 95.93/100 Value rating according to Benzinga Edge Rankings.

Learn more about BZ Edge Rankings — click here to see how Walmart’s Momentum and Value scores compare.

Read Next:

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.