Zinger Key Points

- The automobile industry has experienced ups and downs in 2025 amid President Donald Trump's tariff threats.

- Tesla commands much attention in the markets, though Benzinga Edge grades General Motors higher on key metrics.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

Automobile manufacturers found themselves atop the headlines following President Donald Trump‘s announcement of tariffs against Canada and Mexico. How does the industry stack up following Trump’s temporary postponement of tariffs?

Tesla’s Momentum: Tesla Inc TSLA is the largest automobile manufacturer in the world by market capitalization. The Elon Musk-led company has had a rocky start to 2025; after climbing over 100% to all-time highs in December 2024, the company’s stock is now down over 50%.

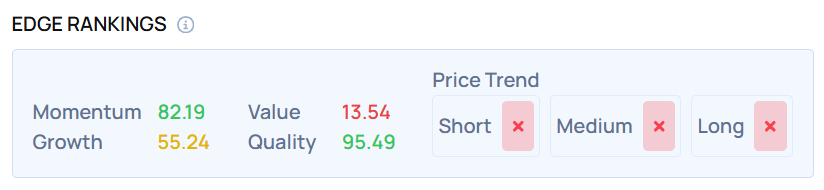

Even amid its fall, the Austin, Texas-based company still has momentum relative to peers, according to Benzinga Edge, which grades stocks based on value, momentum and growth.

Edge rankings put Tesla in the 82nd percentile for momentum, 14th percentile for value and 55th percentile for growth. Tesla’s momentum rating may be surprising given its short-term performance, however, its stock is still up over 29% in the past year.

Tesla’s lagging value rating is perhaps unsurprising. The company’s stock is trading 109 times above earnings and 207 times above free cash flows.

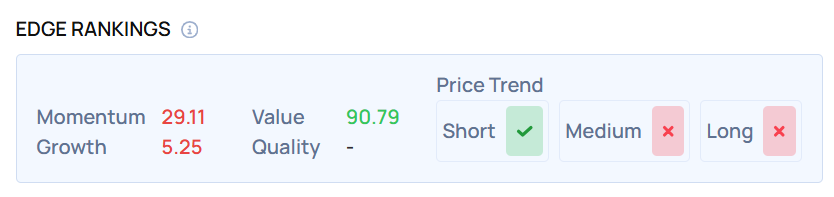

Ford, GM Have Value: In comparison to Tesla, mainstays of the U.S. market Ford Motor Co F and General Motors Co GM could be deep value plays.

Ford grades much higher than Tesla on perceived value, in the 91st percentile. The company is trading 6.82 above earnings as investors price in several macroeconomic tailwinds against the Dearborn-based company.

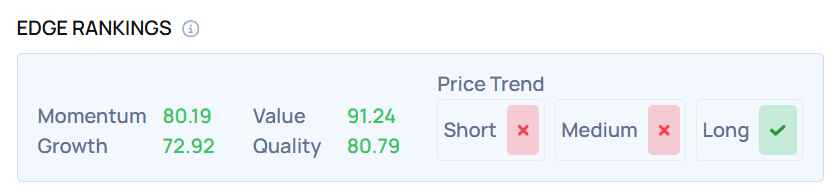

General Motors could be a hidden gem among domestic OEMs. The Detroit-based company grades well among all three attributes. Not only does the company rate well among value, it also has momentum. Its stock up 22% in the past year.

- Unlock the rest of the BZ Edge Rankings and see how fellow Big 3 automaker Stellantis stacks up.

Also Read:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.