Strategy Inc. MSTR, formerly MicroStrategy, has helped bond managers to outperform since the company has issued 0% convertible bonds. According to this analyst, MSTR's "novel strategy" has the potential for great upside in the future.

What Happened: After MSTR established itself as a Bitcoin BTC/USD treasury firm, the company has been issuing 0% convertible bonds and debt to acquire more Bitcoin. The novel thing about the company’s strategy is that they have issued these debt securities for almost no interest cost. So the BTC purchase is funded without having to actually pay for the interest expense.

"Now, you might think that this is a little bit reckless but it turns out it's a very novel strategy. Because they have created a network value, they are one of the largest holders of bitcoin now. Ultimately, they might become the second largest holder of Bitcoin after the U.S. government," said Tom Lee, the CIO at Fundstrat Capital.

According to Lee, bondholders were buying these bonds because they offered, for the first time, the ability to invest a billion dollars in a bond with Bitcoin exposure.

"These have been incredibly high performing bonds, they've been the best performing bonds, so they've helped bond managers outperform by buying typical corporate bonds but with an upside in crypto. So this works unless Bitcoin itself doesn't have a promising future," said Lee.

Why It Matters: The Michael Saylor-led company, which transformed itself five years ago by using the cash on its balance sheet to purchase Bitcoin is no longer valued based on its software business, but it’s valued as a holder of Bitcoin.

Lee believes that Saylor had done something "brilliant," and that over time, as MSTR accumulates enough Bitcoin, the company would be able to do novel things like lending or securing financial systems with the cryptocurrency.

"MSTR is going to be one of the few companies that has a large holding of Bitcoin that you can actually tap, so I kind of applaud the strategy. I think that there is a lot of upside, as long as Bitcoin goes up, MSTR is likely goes up a lot more," added Lee.

Price Action: MSTR shares have declined 1.91% on a year-to-date basis and it’s up 95.81% over a year. Its shares were down 3.29% in premarket on Tuesday whereas the exchange-traded fund tracking the Nasdaq 100 index, Invesco QQQ Trust, Series 1 QQQ was 0.46% lower.

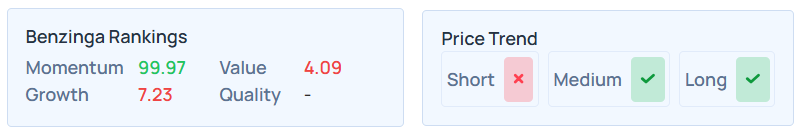

Benzinga's Edge Rankings show a strong price trend in the medium and long term, whereas the short term trend has been poor. While its momentum ranking has been quite high at 99.97 percentile, its value and growth rankings are extremely poor.

Its consensus price target was $494.93, with a ‘buy' rating, based on the 14 analysts tracked by Benzinga. The price targets ranged from a low of $140 to a high of $690. The three latest ratings from Barclays, Keefe, Bruyette & Woods, and Maxim Group averaged at $493.67, implying a 71.88% upside.

Read Next:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.