In a recent Twitch stream, Vivian Jenna Wilson, the estranged daughter of Tesla Inc. TSLA CEO Elon Musk, has stirred controversy by labeling Tesla as a ‘Ponzi scheme’.

What Happened: Vivian Wilson made this statement during a live Twitch stream with Hasan Piker, a prominent political commentator. Wilson criticized her father’s business model for Tesla, equating it to a Ponzi scheme due to its high P/E ratio as compared to other car companies.

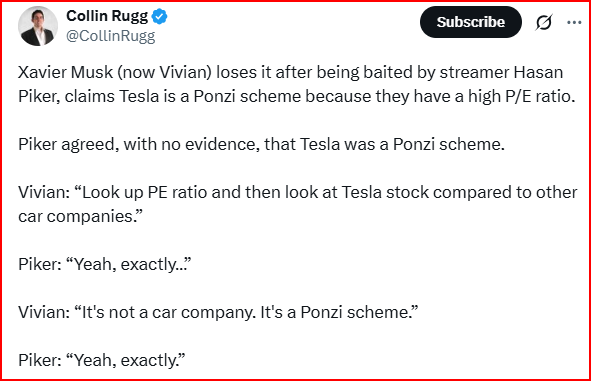

"Look up PE ratio and then look at Tesla stock compared to other car companies,” pointed out Wilson. “It’s not a car company, it’s a Ponzi scheme,” she stated.

Wilson’s comment that this term aptly describes Tesla’s business model has sparked widespread debate on X. Noted investor and media commentator Collin Rugg criticized Wilson and Piker, stating that the streamer “baited” Musk’s estranged daughter and agreed with her statements with “no evidence.”

Musk had earlier accused Piker of being a “fraud” for supporting Assassin’s Creed Shadows, a game he disapproved of. Wilson further talks about Musk overstating his gaming prowess during her conversation with Piker.

Why It Matters: This controversy comes at a time when Tesla’s stock has been under scrutiny. Despite a nearly 50% drop since mid-December, Tesla’s shares are still deemed too pricey by seasoned investor Ross Gerber. Gerber, the president and CEO of Gerber Kawasaki Wealth & Investment Management, expressed doubts about a rebound for Tesla’s stock this year.

Moreover, a Benzinga analysis from early March highlighted Tesla’s position in the competitive automobile industry. As per the analysis, Tesla’s Price to Earnings (P/E) ratio of 143.62 on that date was 12.33x higher than the industry average, indicating the stock was priced at a premium level according to the market sentiment.

Amid massive protests against Tesla across the U.S., Wedbush analyst Dan Ives stays hopeful of the EV maker’s recovery. Ives predicts weaker deliveries for Q1 but says, "This continues to be a moment of truth for Musk to navigate this brand tornado crisis moment and get onto the other side of this dark chapter for Tesla with much better days ahead we see for the story.”

The company, known for its electric vehicles and autonomous driving software, delivered nearly 1.8 million vehicles globally in 2024. However, the company’s high valuation, despite significant losses, continues to be a point of contention among investors.

Tesla stock lost 3.5% to close at $263.55 on Friday.

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.