Boston Scientific Corporation BSX posted better-than-expected earnings for the first quarter on Wednesday.

The company reported first-quarter 2025 revenues of $4.66 billion, beating the consensus estimate of $4.57 billion. The company earned an adjusted EPS of 75 cents, beating the consensus of 67 cents and exceeding the management guidance of 66-68 cents.

"We delivered an exceptional quarter to start the year, reflecting the effectiveness of our highly engaged global team and the strength of our product portfolio," said Mike Mahoney, chairman and chief executive officer of Boston Scientific. "We remain well-positioned for the future as we continue to focus on meaningful innovation, clinical science and the execution of our category leadership strategy to drive differentiated growth and performance for the long-term."

Boston Scientific said it sees net sales growth of approximately 15%-17% in 2025 on a reported basis and around 12%-14% on an organic basis, compared to prior guidance of 12.5%-14.5% and 10%-12%, respectively.

The company estimates 2025 adjusted EPS of $2.87-$2.94 compared to prior guidance of $2.80-$2.87 and the consensus of $2.86.

Boston Scientific shares gained 2.4% to trade at $101.24 on Thursday.

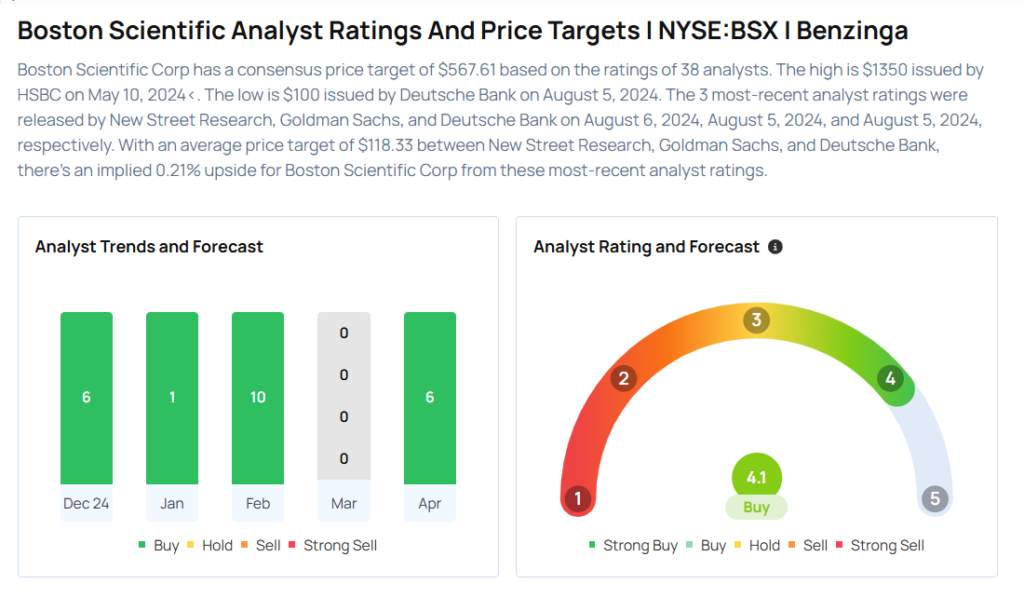

These analysts made changes to their price targets on Boston Scientific following earnings announcement.

- Baird analyst David Rescott maintained Boston Scientific with an Outperform rating and raised the price target from $115 to $120.

- Evercore ISI Group analyst Vijay Kumar maintained the stock with an Outperform rating and increased the price target from $110 to $112.

- Truist Securities analyst Richard Newitter maintained Boston Scientific with a Buy rating and raised the price target from $113 to $117.

- RBC Capital analyst Shagun Singh maintained Boston Scientific with an Outperform rating and raised the price target from $116 to $120.

Considering buying BSX stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.