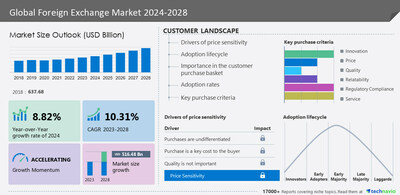

NEW YORK, Nov. 17, 2023 /PRNewswire/ -- The foreign exchange market is estimated to grow by USD 516.48 billion from 2023 to 2028, growing at a CAGR of 10.31%. The foreign exchange market is fragmented owing to the presence of many global and regional companies. A few prominent companies that offer foreign exchange market are Bank of America Corp., Barclays PLC, BNP Paribas SA, Citigroup Inc., Commonwealth Bank of Australia, DBS Bank Ltd., Deutsche Bank AG, HSBC Holdings Plc, JPMorgan Chase and Co., London Stock Exchange Group plc, NatWest Group plc, Societe Generale SA, Standard Chartered PLC, State Street Corp., The Bank of Nova Scotia, The Goldman Sachs Group Inc., UBS Group AG, Westpac Banking Corp., and XTX Markets Ltd.

The report provides a full list of key companies, their strategies, and the latest developments. Download Free Sample before buying

Company Offering:

- Bank of America Corp. - The company offers foreign exchange services such as outbound domestic wire transfer and outbound international wire transfer services.

- Barclays PLC - The company offers foreign exchange services such as Barclays foreign exchange service for personal travel and business transactions.

- BNP Paribas SA - The company offers foreign exchange services such as Cortex FX's advanced multi-product FX trading platform.

- For details on companies and their offerings – Buy a report!

Based on Geography, the market is classified as North America, Europe, APAC, South America, and Middle East and Africa.

- Europe is estimated to contribute 43% to the growth of the global market during the forecast period. North America is also another region that is expected to grow at a significant rate during the forecast period. Between October 2020 and October 2021, the volume of currency transactions in North America increased by 3.6%. This increase in the regions foreign exchange market can be attributed to regular monitoring and control of trade. During the forecast period, sales agents may have an important role in providing auditable standards for trading procedures and this could lead to easier communications among traders.

Download a free sample report to get more insights on the market share of various regions and the contribution of the segments.

- Impactful driver- Growing urbanization and digitalization

- Key Trend - 24x7 trading opportunities for foreign exchange

- Major Challenges - Counterparty risks with respect to foreign exchange

Market Segmentation

- Based on Type, the market is classified into reporting dealers, other financial institutions, and non-financial customers. The reporting dealers segment is estimated to witness significant growth during the forecast period. During the maturity period, the market participants that operate on the foreign exchange market are holding risky inventories. Regarding liquidity, the suppliers who absorb an imbalance in the market shall be rewarded with large returns. Reporting dealers shall be defined as finance companies active in the domestic or international foreign exchange and derivatives markets.

Technavio Research experts have provided more insights on the market share of segments - View the Free Sample Report

Related Reports

The microfinance market size is estimated to grow at a CAGR of 12.86% between 2023 and 2028. The market size is forecast to increase by USD 166.95 billion.

The venture capital investment market size is estimated to decline at a CAGR of 20.88% between 2022 and 2027. The market size is forecast to increase by USD 737.56 billion.

Foreign Exchange Market Scope | |

Report Coverage | Details |

Historic period | 2018-2022 |

Growth momentum & CAGR | Accelerate at a CAGR of 10.31% |

YoY growth 2022-2023 (%) | 8.82 |

Regional analysis | North America, Europe, APAC, South America, and Middle East and Africa |

Key countries | US, China, Japan, UK, and Switzerland |

TOC:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation by Type

7 Market Segmentation by Trade Finance Instruments

8 Customer Landscape

9 Geographic Landscape

10 Drivers, Challenges, and Trends

11 Company Landscape

12 Company Analysis

13 Appendix

About US

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provide actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact US:

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/foreign-exchange-market-to-grow-by-usd-516-48-billion-from-2023-to-2028-market-is-fragmented-due-to-the-presence-of-prominent-companies-like-bank-of-america-corp-barclays-plc-and-bnp-paribas-sa-and-many-more---technavio-301991631.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/foreign-exchange-market-to-grow-by-usd-516-48-billion-from-2023-to-2028-market-is-fragmented-due-to-the-presence-of-prominent-companies-like-bank-of-america-corp-barclays-plc-and-bnp-paribas-sa-and-many-more---technavio-301991631.html

SOURCE Technavio

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.