Discover the latest analyst ratings for Welltower WELL within the last quarter:

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 4 | 4 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 1 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 2 | 0 | 0 |

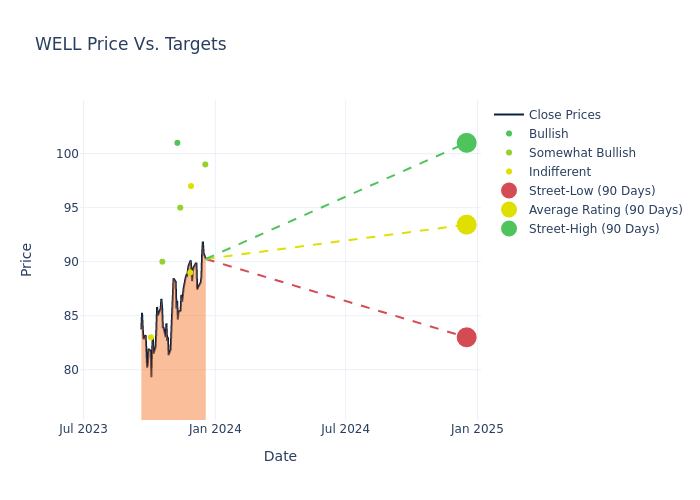

Over the past 3 months, Welltower received 12-month price targets from 9 analysts. The average target is $93.22, with a high of $101.00 and a low of $83.00.

Explore a summary of how these 9 analysts have rated Welltower in the last 3 months. More bullish ratings indicate a positive sentiment, while more bearish ratings signify a negative outlook.

This upward trend is evident, with the current average reflecting a 3.91% increase from the previous average price target of $89.71.

Decoding Analyst Ratings: A Detailed Look

Delve into the insights of financial experts and analysts as we provide a comprehensive breakdown of their recent evaluations for Welltower. Our Ratings Table below offers a detailed overview of the decisions made by key analysts, their current ratings, and price targets. Understanding how these experts perceive the company can yield valuable insights into potential market trends and investor sentiment.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Mueller | JP Morgan | Raises | Overweight | $99.00 | $92.00 |

| Michael Carroll | RBC Capital | Raises | Sector Perform | $97.00 | $92.00 |

| Steve Sakwa | Evercore ISI Group | Raises | In-Line | $89.00 | $86.00 |

| Todd Stender | Wells Fargo | Raises | Overweight | $95.00 | $93.00 |

| Jonathan Hughes | Raymond James | Raises | Strong Buy | $101.00 | $95.00 |

| Todd Thomas | Keybanc | Raises | Overweight | $90.00 | $80.00 |

| Michael Mueller | JP Morgan | Announces | Neutral | $90.00 | - |

| Richard Anderson | Wedbush | Announces | Neutral | $83.00 | - |

| Jonathan Hughes | Raymond James | Raises | Outperform | $95.00 | $90.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Welltower. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Welltower compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Welltower's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Welltower's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Welltower analyst ratings.

Discovering Welltower: A Closer Look

Welltower owns a diversified healthcare portfolio of over 2,000 in-place properties spread across the senior housing, medical office, and skilled nursing/post-acute care sectors. The portfolio includes over 100 properties in both Canada and the United Kingdom as the company looks for additional investment opportunities in countries with mature healthcare systems that operate similarly to that of the United States.

Unraveling the Financial Story of Welltower

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Positive Revenue Trend: Examining Welltower's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 12.77% as of 30 September, 2023, showcasing a substantial increase in top-line earnings. When compared to others in the Real Estate sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Welltower's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 7.67%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Welltower's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 0.58%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.31%, the company showcases effective utilization of assets.

Debt Management: Welltower's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.71.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.