Navigate through 25 recent analyst ratings for Dollar Gen DG within the last quarter:

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 19 | 3 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 7 | 1 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 11 | 2 | 0 |

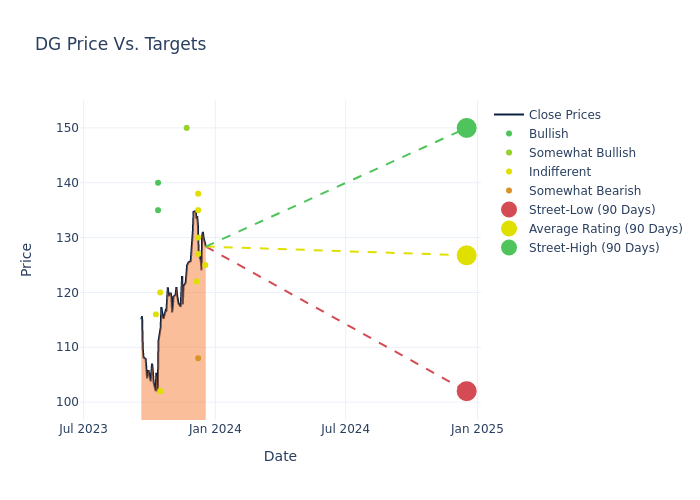

Explore the 12-month price targets set by 25 analysts for Dollar Gen in the last 3 months. The average price target is $123.12, with a high estimate of $150.00 and a low estimate of $102.00.

Explore a quick overview of how 25 analysts rated Dollar Gen in the last 3 months. More bullish ratings signify a positive analyst sentiment, while more bearish ratings suggest a negative outlook.

Highlighting a 6.8% decrease, the current average has fallen from the previous average price target of $132.11.

Exploring Analyst Ratings: An In-Depth Overview

Delve into the insights of financial experts and analysts as we provide a comprehensive breakdown of their recent evaluations for Dollar Gen. Our Ratings Table below offers a detailed overview of the decisions made by key analysts, their current ratings, and price targets. Understanding how these experts perceive the company can yield valuable insights into potential market trends and investor sentiment.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Scot Ciccarelli | Truist Securities | Raises | Hold | $125.00 | $117.00 |

| Peter Keith | Piper Sandler | Raises | Neutral | $127.00 | $114.00 |

| Matthew Boss | JP Morgan | Raises | Underweight | $108.00 | $107.00 |

| Scot Ciccarelli | Truist Securities | Raises | Hold | $117.00 | $116.00 |

| Simeon Gutman | Morgan Stanley | Raises | Equal-Weight | $130.00 | $125.00 |

| Paul Lejuez | Citigroup | Raises | Neutral | $138.00 | $115.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Market Perform | $135.00 | $124.00 |

| Edward Kelly | Wells Fargo | Raises | Equal-Weight | $122.00 | $110.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Market Perform | $124.00 | - |

| Bobby Griffin | Raymond James | Lowers | Outperform | $150.00 | $160.00 |

| Anthony Chukumba | Loop Capital | Lowers | Hold | $120.00 | $140.00 |

| Paul Lejuez | Citigroup | Lowers | Neutral | $115.00 | $146.00 |

| Daniela Bretthauer | HSBC | Announces | Hold | $102.00 | - |

| Paul Lejuez | Citigroup | Lowers | Neutral | $115.00 | $146.00 |

| Corey Tarlowe | Jefferies | Lowers | Buy | $135.00 | $175.00 |

| Scot Ciccarelli | Truist Securities | Lowers | Hold | $116.00 | $117.00 |

| Simeon Gutman | Morgan Stanley | Lowers | Equal-Weight | $125.00 | $135.00 |

| Peter Keith | Piper Sandler | Lowers | Neutral | $114.00 | $144.00 |

| Chuck Grom | Gordon Haskett | Announces | Buy | $140.00 | - |

| Joseph Feldman | Telsey Advisory Group | Lowers | Market Perform | $124.00 | $145.00 |

| Steve McManus | Exane BNP Paribas | Announces | Neutral | $116.00 | - |

| Scot Ciccarelli | Truist Securities | Lowers | Hold | $117.00 | $142.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Market Perform | $145.00 | - |

| Daniela Bretthauer | HSBC | Announces | Reduce | $102.00 | - |

| Matthew Boss | JP Morgan | Lowers | Underweight | $116.00 | $132.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Dollar Gen. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Dollar Gen compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Dollar Gen's stock. This examination reveals shifts in analysts' expectations over time.

For valuable insights into Dollar Gen's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Dollar Gen analyst ratings.

About Dollar Gen

With over 19,000 locations, Dollar General's banner is nearly ubiquitous across the rural United States. Dollar General serves as a convenient shopping destination for fill-in store trips, with its value proposition most relevant to consumers in small communities with a dearth of shopping options. The retailer operates a frugal store of about 7,500 square feet and primarily offers an assortment of branded and private-label consumable items (80% of net sales) such as paper and cleaning products, packaged and perishable food, tobacco, and health and beauty items at low prices. Dollar General also offers a limited assortment of seasonal merchandise, home products, and apparel. The firm sells most items at a price point of $10 or lower.

A Deep Dive into Dollar Gen's Financials

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Dollar Gen's revenue growth over a period of 3 months has been noteworthy. As of 31 October, 2023, the company achieved a revenue growth rate of approximately 2.42%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Staples sector.

Net Margin: Dollar Gen's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.85% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 4.33%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Dollar Gen's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.91%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Dollar Gen's debt-to-equity ratio stands notably higher than the industry average, reaching 2.8. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

What Are Analyst Ratings?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.