Analysts have provided the following ratings for Amicus Therapeutics FOLD within the last quarter:

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

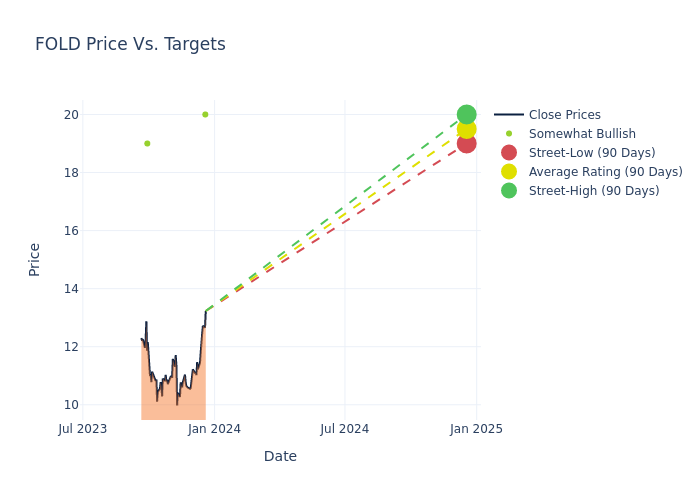

In the last quarter, Amicus Therapeutics received 12-month price targets from 4 analysts. The average target price is $17.0, with a high estimate of $20.00 and a low estimate of $14.00.

Learn about 4 analysts' views on Amicus Therapeutics over the past 3 months. Increased bullish ratings reflect positive sentiment, while increased bearish ratings suggest a negative outlook.

This average price target has increased by 11.48% over the past month.

Diving into Analyst Ratings: An In-Depth Exploration

Delve into the insights of financial experts and analysts as we provide a comprehensive breakdown of their recent evaluations for Amicus Therapeutics. Our Ratings Table below offers a detailed overview of the decisions made by key analysts, their current ratings, and price targets. Understanding how these experts perceive the company can yield valuable insights into potential market trends and investor sentiment.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jeffrey Hung | Morgan Stanley | Raises | Overweight | $20.00 | $15.00 |

| Andrew Galler | Morgan Stanley | Raises | Equal-Weight | $15.00 | $14.00 |

| Andrew Galler | Morgan Stanley | Lowers | Equal-Weight | $14.00 | $15.00 |

| Anupam Rama | JP Morgan | Raises | Overweight | $19.00 | $17.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Amicus Therapeutics. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Amicus Therapeutics compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Amicus Therapeutics's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Amicus Therapeutics's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Amicus Therapeutics analyst ratings.

Discovering Amicus Therapeutics: A Closer Look

Amicus Therapeutics Inc is a biotechnology company focused on discovering, developing and delivering medicines for people living with rare metabolic diseases. The company is engaged in developing a pipeline of medicines for rare metabolic diseases, including a rare disease gene therapy portfolio. It has a portfolio of product opportunities, including oral precision medicine for people living with Fabry disease who have amenable genetic variants; a clinical-stage, treatment paradigm for Pompe disease, and a rare disease gene therapy portfolio. The company has one segment focused on the discovery, development, and commercialization of advanced therapies to treat a range of devastating rare and orphan diseases.

Unraveling the Financial Story of Amicus Therapeutics

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Amicus Therapeutics's remarkable performance in 3 months is evident. As of 30 September, 2023, the company achieved an impressive revenue growth rate of 26.7%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Amicus Therapeutics's net margin excels beyond industry benchmarks, reaching -20.85%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Amicus Therapeutics's ROE excels beyond industry benchmarks, reaching -17.63%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Amicus Therapeutics's ROA stands out, surpassing industry averages. With an impressive ROA of -2.89%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 3.41, caution is advised due to increased financial risk.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.