Across the recent three months, 7 analysts have shared their insights on Teleflex TFX, expressing a variety of opinions spanning from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 5 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 3 | 2 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

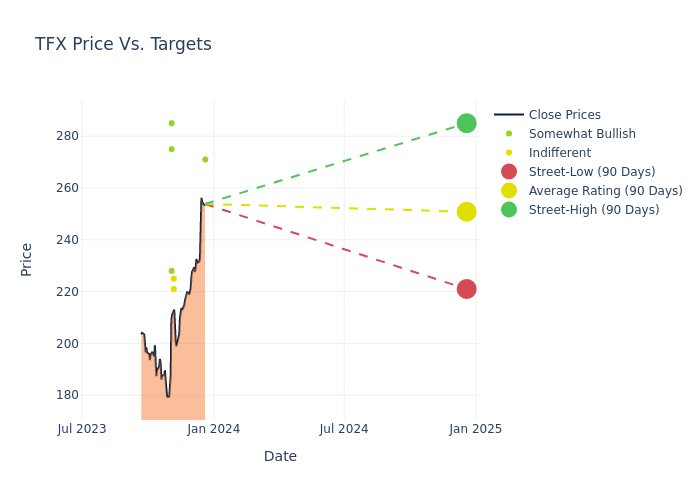

Analysts have set 12-month price targets for Teleflex, revealing an average target of $260.0, a high estimate of $315.00, and a low estimate of $221.00. Witnessing a positive shift, the current average has risen by 10.17% from the previous average price target of $236.00.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Teleflex among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jayson Bedford | Raymond James | Raises | Outperform | $271.00 | $227.00 |

| Matt O'Brien | Piper Sandler | Raises | Neutral | $225.00 | $210.00 |

| Richard Newitter | Truist Securities | Raises | Hold | $221.00 | $210.00 |

| David Turkaly | JMP Securities | Lowers | Market Outperform | $285.00 | $315.00 |

| Shagun Singh | RBC Capital | Raises | Outperform | $228.00 | $218.00 |

| George Sellers | Stephens & Co. | Maintains | Overweight | $275.00 | - |

| George Sellers | Stephens & Co. | Maintains | Overweight | $315.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Teleflex. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Teleflex compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Teleflex's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Teleflex's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Teleflex analyst ratings.

Unveiling the Story Behind Teleflex

Teleflex is a Wayne, Pennsylvania-based manufacturer of hospital supplies and medical devices primarily in the bloodstream/vascular and surgical areas. The firm reports results across seven segments: vascular access (24% of 2022 sales), interventional (16%), anesthesia (14%), surgical (14%), interventional urology (12%), original-equipment manufacturing (10%), and all other (10%). Geographic exposure for the business is primarily in the U.S., which accounts for 60% of revenue, with international markets making up the remainder.

Unraveling the Financial Story of Teleflex

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Teleflex showcased positive performance, achieving a revenue growth rate of 8.68% as of 30 September, 2023. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Teleflex's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 18.37%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Teleflex's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 3.22%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Teleflex's ROA excels beyond industry benchmarks, reaching 1.91%. This signifies efficient management of assets and strong financial health.

Debt Management: Teleflex's debt-to-equity ratio is below the industry average. With a ratio of 0.5, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Significance of Analyst Ratings Explained

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.