In the latest quarter, 5 analysts provided ratings for Boston Props BXP, showcasing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 2 | 0 | 0 |

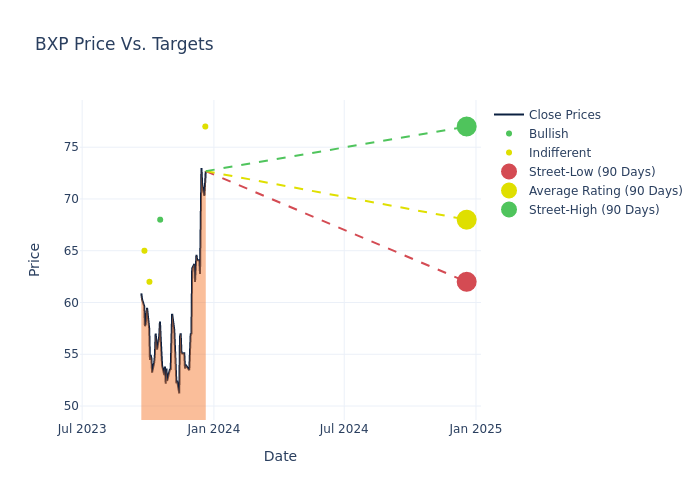

The 12-month price targets, analyzed by analysts, offer insights with an average target of $66.4, a high estimate of $77.00, and a low estimate of $60.00. Experiencing a 5.59% decline, the current average is now lower than the previous average price target of $70.33.

Diving into Analyst Ratings: An In-Depth Exploration

The analysis of recent analyst actions sheds light on the perception of Boston Props by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Alexander Goldfarb | Piper Sandler | Raises | Neutral | $77.00 | $60.00 |

| Alexander Goldfarb | Piper Sandler | Lowers | Neutral | $60.00 | $66.00 |

| Vikram Malhotra | Mizuho | Lowers | Buy | $68.00 | $85.00 |

| Richard Anderson | Wedbush | Announces | Neutral | $62.00 | - |

| Floris Van Dijkum | Compass Point | Announces | Neutral | $65.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Boston Props. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Boston Props compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Boston Props's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Boston Props's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Boston Props analyst ratings.

Discovering Boston Props: A Closer Look

Boston Properties owns over 190 properties consisting of approximately 54 million rentable square feet of space. The portfolio is dominated by office buildings and is spread across major cities such as New York, Boston, San Francisco, Los Angeles, Seattle, and the Washington, D.C., region. The real estate investment trust also owns limited retail, hotel, and residential properties.

A Deep Dive into Boston Props's Financials

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Boston Props displayed positive results in 3 months. As of 30 September, 2023, the company achieved a solid revenue growth rate of approximately 4.27%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: Boston Props's net margin excels beyond industry benchmarks, reaching -13.57%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Boston Props's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -1.89%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of -0.45%, the company showcases effective utilization of assets.

Debt Management: Boston Props's debt-to-equity ratio surpasses industry norms, standing at 2.69. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Significance of Analyst Ratings Explained

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.