6 analysts have shared their evaluations of Invitation Homes INVH during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 5 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 2 | 0 | 0 | 0 |

| 3M Ago | 1 | 2 | 0 | 0 | 0 |

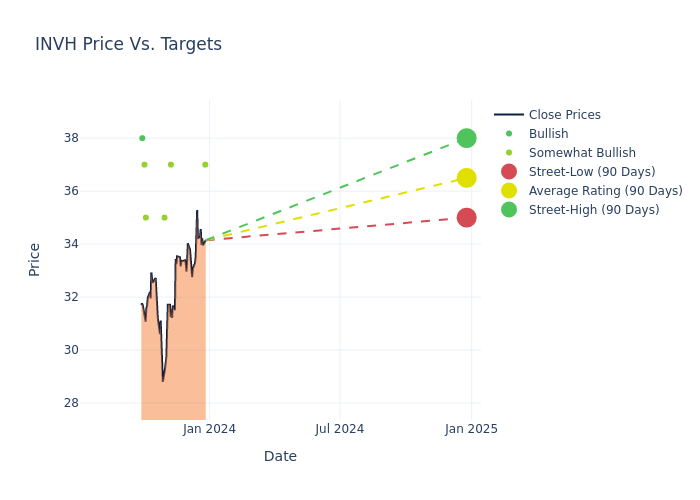

In the assessment of 12-month price targets, analysts unveil insights for Invitation Homes, presenting an average target of $36.5, a high estimate of $38.00, and a low estimate of $35.00. A decline of 3.11% from the prior average price target is evident in the current average.

Analyzing Analyst Ratings: A Detailed Breakdown

The analysis of recent analyst actions sheds light on the perception of Invitation Homes by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Adam Kramer | Morgan Stanley | Lowers | Overweight | $37.00 | $38.00 |

| Buck Horne | Raymond James | Lowers | Outperform | $37.00 | $38.00 |

| Tyler Batory | Oppenheimer | Announces | Outperform | $35.00 | - |

| Austin Wurschmidt | Keybanc | Lowers | Overweight | $35.00 | $37.00 |

| Steve Sakwa | Evercore ISI Group | Announces | Outperform | $37.00 | - |

| Michael Goldsmith | UBS | Announces | Buy | $38.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Invitation Homes. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Invitation Homes compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Invitation Homes's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Invitation Homes's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Invitation Homes analyst ratings.

Discovering Invitation Homes: A Closer Look

Invitation Homes owns a portfolio of nearly 83,000 single-family rental homes. The company focuses on owning homes in the starter and move-up segments of the housing market with an average sale price around $300,000 and generally less than 1,800 square feet. The portfolio is spread across 16 target markets that feature high employment and household formation growth with over 70% of the portfolio in the Western U.S. and Florida; 15 of the 16 markets featuring average rents lower than homeownership costs.

Breaking Down Invitation Homes's Financial Performance

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Invitation Homes's remarkable performance in 3 months is evident. As of 30 September, 2023, the company achieved an impressive revenue growth rate of 8.62%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Real Estate sector.

Net Margin: Invitation Homes's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 21.31% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Invitation Homes's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.29% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.69%, the company showcases effective utilization of assets.

Debt Management: Invitation Homes's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.84.

Analyst Ratings: Simplified

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.