Ratings for Nike NKE were provided by 17 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 7 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 5 | 5 | 3 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

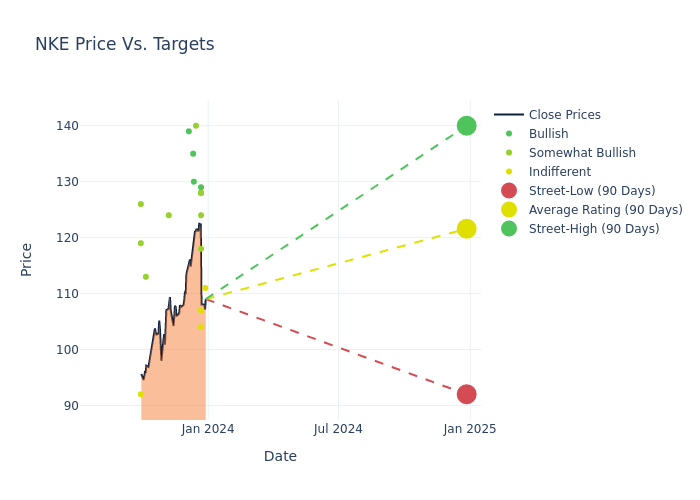

Analysts have set 12-month price targets for Nike, revealing an average target of $122.06, a high estimate of $140.00, and a low estimate of $104.00. Marking an increase of 0.94%, the current average surpasses the previous average price target of $120.92.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Nike among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Beth Reed | Truist Securities | Raises | Hold | $111.00 | $107.00 |

| Jim Duffy | Stifel | Lowers | Buy | $129.00 | $135.00 |

| Abbie Zvejnieks | Piper Sandler | Lowers | Neutral | $107.00 | $112.00 |

| Beth Reed | Truist Securities | Lowers | Hold | $107.00 | $108.00 |

| Matthew Korn | JP Morgan | Lowers | Overweight | $128.00 | $139.00 |

| Simeon Siegel | BMO Capital | Raises | Outperform | $118.00 | $110.00 |

| Rick Patel | Raymond James | Lowers | Outperform | $124.00 | $130.00 |

| John Kernan | TD Cowen | Lowers | Market Perform | $104.00 | $129.00 |

| Gabriella Carbone | Deutsche Bank | Lowers | Buy | $128.00 | $132.00 |

| Rick Patel | Raymond James | Raises | Outperform | $130.00 | $121.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Outperform | $140.00 | $128.00 |

| Katharina Schmenger | DZ Bank | Announces | Buy | $130.00 | - |

| Paul Lejuez | Citigroup | Raises | Buy | $135.00 | $100.00 |

| Brooke Roach | Goldman Sachs | Announces | Buy | $139.00 | - |

| Beth Reed | Truist Securities | Announces | Hold | $108.00 | - |

| Michael Binetti | Evercore ISI Group | Announces | Outperform | $124.00 | - |

| Piral Dadhania | RBC Capital | Maintains | Outperform | $113.00 | - |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Nike. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Nike compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Nike's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Nike's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Nike analyst ratings.

About Nike

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan, and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

Nike: Financial Performance Dissected

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Nike displayed positive results in 3 months. As of 30 November, 2023, the company achieved a solid revenue growth rate of approximately 3.47%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Nike's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 11.79% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Nike's ROE stands out, surpassing industry averages. With an impressive ROE of 11.22%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Nike's ROA stands out, surpassing industry averages. With an impressive ROA of 4.27%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Nike's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.86.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.