Providing a diverse range of perspectives from bullish to bearish, 5 analysts have published ratings on Lincoln National LNC in the last three months.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 4 | 1 | 0 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 3 | 0 | 0 |

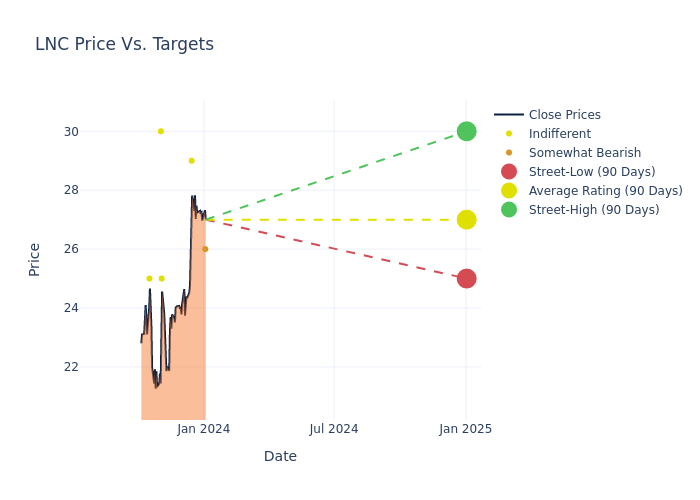

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $27.0, a high estimate of $30.00, and a low estimate of $25.00. Highlighting a 3.57% decrease, the current average has fallen from the previous average price target of $28.00.

Breaking Down Analyst Ratings: A Detailed Examination

In examining recent analyst actions, we gain insights into how financial experts perceive Lincoln National. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jimmy Bhullar | JP Morgan | Announces | Underweight | $26.00 | - |

| Thomas Gallagher | Evercore ISI Group | Raises | In-Line | $29.00 | $26.00 |

| John Barnidge | Piper Sandler | Lowers | Neutral | $25.00 | $27.00 |

| Nigel Dally | Morgan Stanley | Lowers | Equal-Weight | $30.00 | $32.00 |

| Elyse Greenspan | Wells Fargo | Lowers | Equal-Weight | $25.00 | $27.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Lincoln National. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Lincoln National compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Lincoln National's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Lincoln National's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Lincoln National analyst ratings.

Discovering Lincoln National: A Closer Look

Lincoln National Corp operates multiple insurance and retirement businesses. The company's operating segment includes Annuities; Retirement Plan Services; Life Insurance and Group Protection. Its products primarily include fixed and indexed annuities, variable annuities, universal life insurance (UL), variable universal life insurance (VUL), linked-benefit UL and VUL, indexed universal life insurance (IUL), term life insurance, employer-sponsored retirement plans and services, and group life, disability and dental.

A Deep Dive into Lincoln National's Financials

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Lincoln National's financials over 3 months reveals challenges. As of 30 September, 2023, the company experienced a decline of approximately -11.9% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: Lincoln National's net margin is impressive, surpassing industry averages. With a net margin of 19.37%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Lincoln National's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 23.25%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Lincoln National's ROA excels beyond industry benchmarks, reaching 0.24%. This signifies efficient management of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 2.67, caution is advised due to increased financial risk.

How Are Analyst Ratings Determined?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.