9 analysts have expressed a variety of opinions on CME Gr CME over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 3 | 0 | 2 |

| Last 30D | 0 | 0 | 0 | 0 | 1 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 2 | 3 | 0 | 1 |

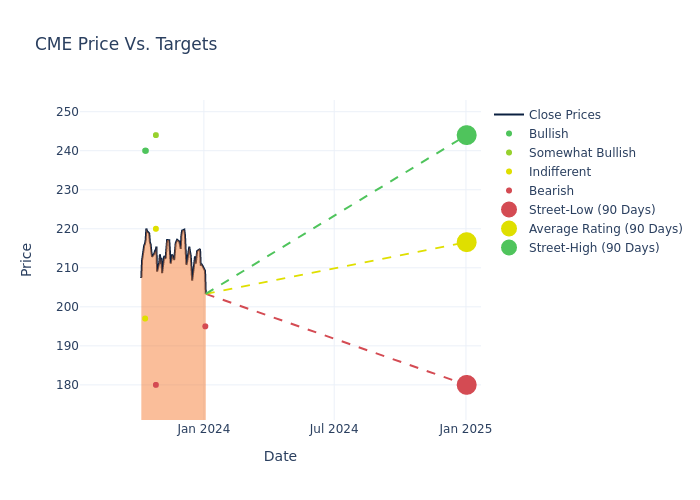

Analysts have recently evaluated CME Gr and provided 12-month price targets. The average target is $219.78, accompanied by a high estimate of $247.00 and a low estimate of $180.00. This upward trend is apparent, with the current average reflecting a 3.12% increase from the previous average price target of $213.12.

Diving into Analyst Ratings: An In-Depth Exploration

An in-depth analysis of recent analyst actions unveils how financial experts perceive CME Gr. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Alexander Blostein | Goldman Sachs | Announces | Sell | $195.00 | - |

| Mike Cyprys | Morgan Stanley | Raises | Equal-Weight | $220.00 | $215.00 |

| Andrew Bond | Rosenblatt | Raises | Sell | $180.00 | $173.00 |

| Jeremy Campbell | Barclays | Lowers | Overweight | $244.00 | $247.00 |

| Christopher Allen | Citigroup | Raises | Buy | $240.00 | $215.00 |

| Kenneth Billingsley | JP Morgan | Raises | Neutral | $197.00 | $190.00 |

| Mike Cyprys | Morgan Stanley | Raises | Equal-Weight | $215.00 | $211.00 |

| Brian Bedell | Deutsche Bank | Raises | Buy | $240.00 | $224.00 |

| Jeremy Campbell | Barclays | Raises | Overweight | $247.00 | $230.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to CME Gr. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of CME Gr compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for CME Gr's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of CME Gr's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on CME Gr analyst ratings.

Unveiling the Story Behind CME Gr

Based in Chicago, CME Group operates exchanges giving investors, suppliers, and businesses the ability to trade futures and derivatives based on interest rates, equity indexes, foreign currencies, energy, metals, and commodities. The CME was founded in 1898 and in 2002 completed its initial public offering. Since then, CME Group has consolidated parts of the industry by merging with crosstown rival, CBOT Holdings in 2007 before acquiring Nymex Holdings in 2008 and NEX in 2018. In addition, the company has a 27% stake in S&P Dow Jones Indices, making the Chicago Mercantile Exchange the exclusive venue to trade and clear S&P futures contracts. Through CME's acquisition of NEX in 2018 it has also expanded into cash foreign exchange, fixed income trading, and collateral optimization.

CME Gr: Financial Performance Dissected

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Over the 3 months period, CME Gr showcased positive performance, achieving a revenue growth rate of 8.96% as of 30 September, 2023. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: CME Gr's net margin excels beyond industry benchmarks, reaching 55.37%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 2.65%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): CME Gr's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.54%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: CME Gr's debt-to-equity ratio is below the industry average at 0.12, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: Simplified

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.