Providing a diverse range of perspectives from bullish to bearish, 4 analysts have published ratings on Kennametal KMT in the last three months.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 2 | 1 | 1 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 1 | 1 |

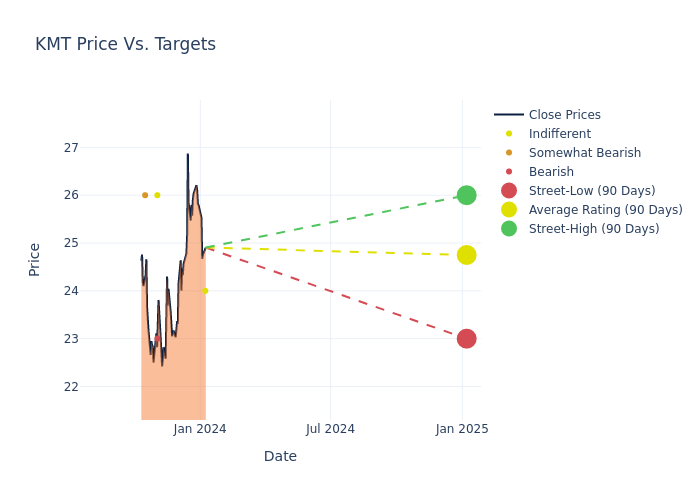

In the assessment of 12-month price targets, analysts unveil insights for Kennametal, presenting an average target of $24.75, a high estimate of $26.00, and a low estimate of $23.00. Experiencing a 11.61% decline, the current average is now lower than the previous average price target of $28.00.

Deciphering Analyst Ratings: An In-Depth Analysis

A clear picture of Kennametal's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Angel Castillo | Morgan Stanley | Announces | Equal-Weight | $24.00 | - |

| Julian Mitchell | Barclays | Lowers | Equal-Weight | $26.00 | $28.00 |

| Joe Ritchie | Goldman Sachs | Lowers | Sell | $23.00 | $26.00 |

| Tami Zakaria | JP Morgan | Lowers | Underweight | $26.00 | $30.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Kennametal. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Kennametal compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Kennametal's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into Kennametal's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Kennametal analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Kennametal

Kennametal Inc is a manufacturer of metalworking tools and wear-resistant engineered components and coatings. The company operates in two business segments: Metal Cutting and infrastructure. It generates maximum revenue from the Metal Cutting segment. The Metal Cutting segment develops and manufactures high performance tooling and metal cutting products and services and offers an assortment of standard and custom metal cutting solutions to diverse end markets, including aerospace, general engineering, energy, and transportation. Geographically, it derives a majority of revenue from the United States.

Unraveling the Financial Story of Kennametal

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Negative Revenue Trend: Examining Kennametal's financials over 3 months reveals challenges. As of 30 September, 2023, the company experienced a decline of approximately -0.47% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Kennametal's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 6.1%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Kennametal's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.37%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Kennametal's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 1.19%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Kennametal's debt-to-equity ratio is below the industry average at 0.53, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Significance of Analyst Ratings Explained

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.