In the preceding three months, 8 analysts have released ratings for JPMorgan Chase JPM, presenting a wide array of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 5 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 3 | 1 | 0 | 0 |

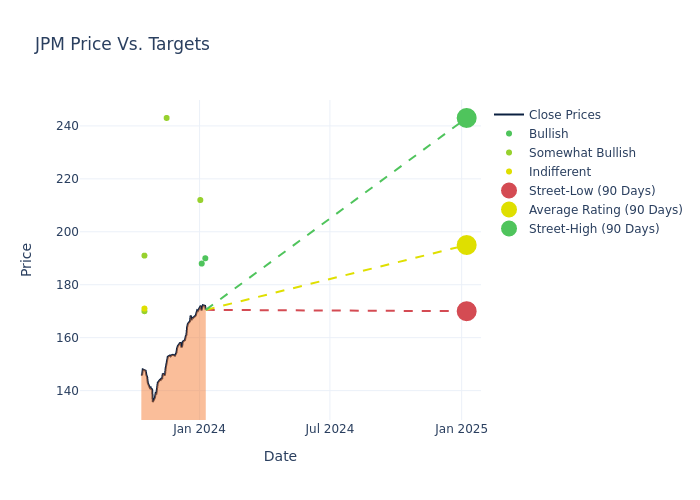

In the assessment of 12-month price targets, analysts unveil insights for JPMorgan Chase, presenting an average target of $199.75, a high estimate of $243.00, and a low estimate of $170.00. This upward trend is evident, with the current average reflecting a 8.49% increase from the previous average price target of $184.12.

Breaking Down Analyst Ratings: A Detailed Examination

A clear picture of JPMorgan Chase's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Matt O'Connor | Deutsche Bank | Raises | Buy | $190.00 | $140.00 |

| Ebrahim Poonawala | B of A Securities | Raises | Buy | $188.00 | $177.00 |

| Jason Goldberg | Barclays | Raises | Overweight | $212.00 | $186.00 |

| Chris Kotowski | Oppenheimer | Raises | Outperform | $243.00 | $233.00 |

| Scott Siefers | Piper Sandler | Raises | Overweight | $170.00 | $168.00 |

| James Fotheringham | BMO Capital | Raises | Market Perform | $171.00 | $167.00 |

| Chris Kotowski | Oppenheimer | Raises | Outperform | $233.00 | $215.00 |

| Betsy Graseck | Morgan Stanley | Raises | Overweight | $191.00 | $187.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to JPMorgan Chase. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of JPMorgan Chase compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of JPMorgan Chase's stock. This examination reveals shifts in analysts' expectations over time.

Capture valuable insights into JPMorgan Chase's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on JPMorgan Chase analyst ratings.

All You Need to Know About JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segments--consumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management. JPMorgan operates, and is subject to regulation, in multiple countries.

Unraveling the Financial Story of JPMorgan Chase

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: JPMorgan Chase's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2023, the company achieved a revenue growth rate of approximately 21.59%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Financials sector.

Net Margin: JPMorgan Chase's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 31.9% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.41%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): JPMorgan Chase's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.33% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: JPMorgan Chase's debt-to-equity ratio is below the industry average at 1.41, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.