5 analysts have shared their evaluations of RBC Bearings RBC during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

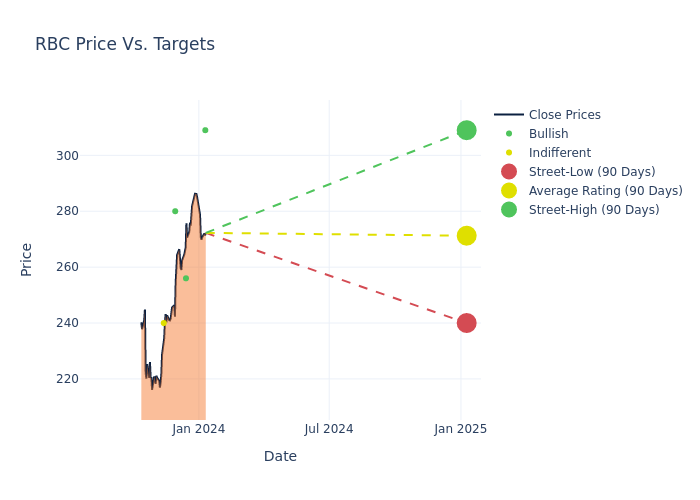

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $271.2, along with a high estimate of $309.00 and a low estimate of $240.00. Witnessing a positive shift, the current average has risen by 9.35% from the previous average price target of $248.00.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive RBC Bearings is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Ciarmoli | Truist Securities | Raises | Buy | $309.00 | $271.00 |

| Joe Ritchie | Goldman Sachs | Raises | Buy | $256.00 | $229.00 |

| Ronald Epstein | B of A Securities | Raises | Buy | $280.00 | $230.00 |

| Seth Weber | Wells Fargo | Raises | Equal-Weight | $240.00 | $235.00 |

| Michael Ciarmoli | Truist Securities | Lowers | Buy | $271.00 | $275.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to RBC Bearings. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of RBC Bearings compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for RBC Bearings's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of RBC Bearings's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on RBC Bearings analyst ratings.

Discovering RBC Bearings: A Closer Look

RBC Bearings Inc is a manufacturer and marketer of precision bearings and products used in aircraft and mechanical systems. The offering includes plain bearings, roller bearings, ball bearings, and engineered products. The products reduce wear in moving parts, facilitate proper power transmission, reduce damage and energy loss, and control pressure and flow. The primary customers for RBC Bearings are industrial markets and aerospace markets such as construction and mining, oil and natural resource extraction, heavy truck, marine, rail and train, packaging, commercial, private and military aircraft engines, and guided weaponry. The end market is the United States of America.

RBC Bearings's Economic Impact: An Analysis

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining RBC Bearings's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 4.44% as of 30 September, 2023, showcasing a substantial increase in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 11.9%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): RBC Bearings's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 1.76%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): RBC Bearings's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.98%, the company may face hurdles in achieving optimal financial returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.52.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.