In the latest quarter, 4 analysts provided ratings for Newmont NEM, showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

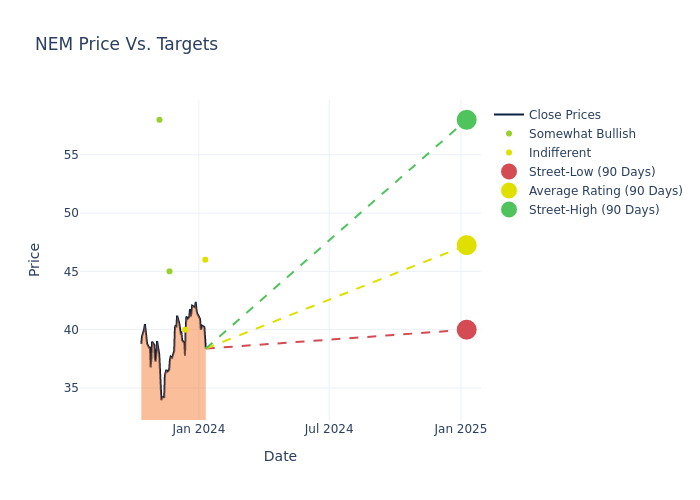

In the assessment of 12-month price targets, analysts unveil insights for Newmont, presenting an average target of $47.25, a high estimate of $58.00, and a low estimate of $40.00. This current average reflects an increase of 12.5% from the previous average price target of $42.00.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Newmont among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Greg Barnes | TD Securities | Announces | Hold | $46.00 | - |

| Cleve Rueckert | UBS | Lowers | Neutral | $40.00 | $42.00 |

| Andrew Bowler | Macquarie | Announces | Outperform | $45.00 | - |

| Jackie Przybylowski | BMO Capital | Announces | Outperform | $58.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Newmont. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Newmont compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Newmont's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Newmont's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Newmont analyst ratings.

Unveiling the Story Behind Newmont

Newmont is the world's largest gold miner. It bought Goldcorp in 2019, combined its Nevada mines in a joint venture with competitor Barrick later that year, and also purchased competitor Newcrest in November 2023. Its portfolio includes 17 wholly or majority owned mines and interests in two joint ventures in the Americas, Africa, Australia and Papua New Guinea. The company is expected to produce roughly 7.3 million ounces of gold in 2023 pro forma for Newcrest on an annualized basis. Newmont also produces material amounts of copper, silver, zinc, and lead as byproducts from its various gold mines. It had about two decades of gold reserves along with significant byproduct reserves after acquiring Newcrest.

Unraveling the Financial Story of Newmont

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Negative Revenue Trend: Examining Newmont's financials over 3 months reveals challenges. As of 30 September, 2023, the company experienced a decline of approximately -5.35% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Newmont's net margin is impressive, surpassing industry averages. With a net margin of 6.34%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 0.83%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Newmont's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.41% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Newmont's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.32, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.