UDR UDR underwent analysis by 7 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 5 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 3 | 1 | 0 |

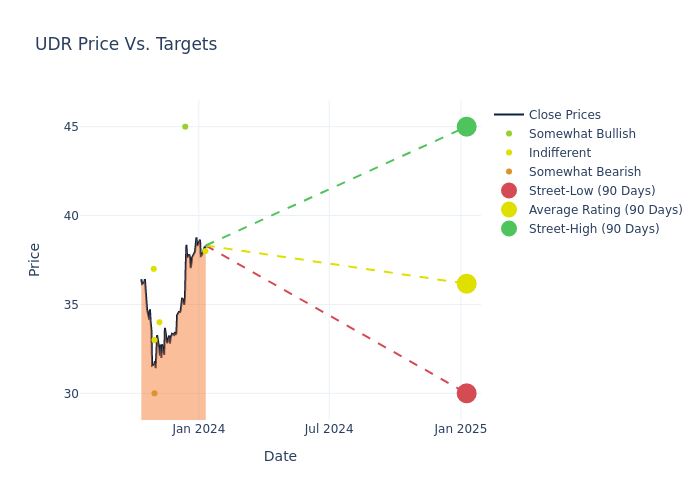

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $35.86, with a high estimate of $45.00 and a low estimate of $30.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 13.3%.

Interpreting Analyst Ratings: A Closer Look

The perception of UDR by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Vikram Malhorta | Mizuho | Raises | Neutral | $38.00 | $34.00 |

| Todd Thomas | Keybanc | Lowers | Overweight | $45.00 | $48.00 |

| Haendel St. Juste | Mizuho | Lowers | Neutral | $34.00 | $38.00 |

| James Feldman | Wells Fargo | Lowers | Equal-Weight | $34.00 | $42.50 |

| Joshua Dennerlein | B of A Securities | Lowers | Neutral | $33.00 | $42.00 |

| Alexander Goldfarb | Piper Sandler | Lowers | Underweight | $30.00 | $46.00 |

| Brad Heffern | RBC Capital | Lowers | Sector Perform | $37.00 | $39.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to UDR. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of UDR compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of UDR's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of UDR's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on UDR analyst ratings.

Unveiling the Story Behind UDR

UDR is a real estate investment trust that owns, operates, acquires, renovates, develops, redevelops, disposes of, and manages multifamily apartment communities in targeted markets located in the United States. The company has two reportable segments; Same-Store Communities segment represents those communities acquired, developed, and stabilized prior to January 1, 2021, and held as of December 31, 2022, and Non-Mature Communities/Other segment represents those communities that do not meet the criteria to be included in Same-Store Communities, including, but not limited to, recently acquired, developed and redeveloped communities, and the non-apartment components of mixed-use properties. The company generates key revenue from Same-Store Communities.

UDR: Financial Performance Dissected

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: UDR displayed positive results in 3 months. As of 30 September, 2023, the company achieved a solid revenue growth rate of approximately 4.81%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: UDR's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 7.71%, the company may face hurdles in effective cost management.

Return on Equity (ROE): UDR's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 0.77%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): UDR's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.28%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a below-average debt-to-equity ratio of 1.45, UDR adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.