Across the recent three months, 6 analysts have shared their insights on Louisiana-Pacific LPX, expressing a variety of opinions spanning from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

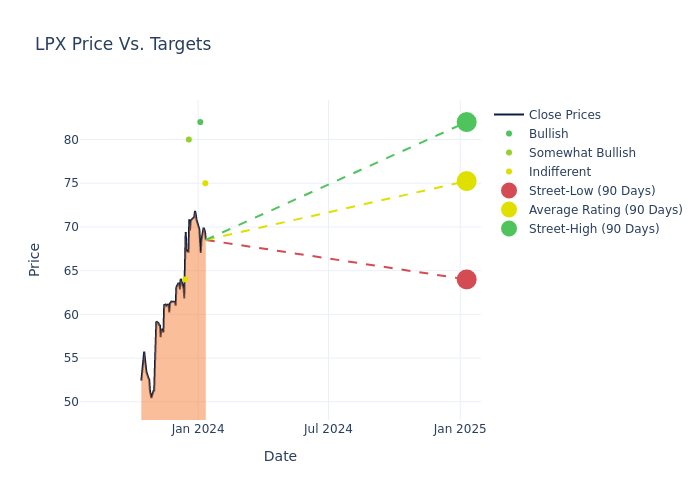

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $74.67, a high estimate of $82.00, and a low estimate of $64.00. This current average has increased by 4.29% from the previous average price target of $71.60.

Investigating Analyst Ratings: An Elaborate Study

The standing of Louisiana-Pacific among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Sean Steuart | TD Cowen | Announces | Hold | $75.00 | - |

| Michael Roxland | Truist Securities | Raises | Buy | $82.00 | $75.00 |

| Paul Quinn | RBC Capital | Raises | Outperform | $80.00 | $72.00 |

| Susan Maklari | Goldman Sachs | Raises | Neutral | $64.00 | $57.00 |

| Michael Roxland | Truist Securities | Lowers | Buy | $75.00 | $79.00 |

| Paul Quinn | RBC Capital | Lowers | Outperform | $72.00 | $75.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Louisiana-Pacific. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Louisiana-Pacific compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Louisiana-Pacific's stock. This analysis reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Louisiana-Pacific's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Louisiana-Pacific analyst ratings.

Delving into Louisiana-Pacific's Background

Louisiana-Pacific is primarily an oriented strand board producer, while offering engineered wood siding used in home construction and repair and remodel projects. The company is largely exposed to the North American housing market but has also established capacity in Brazil and Chile.

Breaking Down Louisiana-Pacific's Financial Performance

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Negative Revenue Trend: Examining Louisiana-Pacific's financials over 3 months reveals challenges. As of 30 September, 2023, the company experienced a decline of approximately -14.55% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Materials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 16.21%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Louisiana-Pacific's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 8.09% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Louisiana-Pacific's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 5.04%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.25, Louisiana-Pacific adopts a prudent financial strategy, indicating a balanced approach to debt management.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.