Providing a diverse range of perspectives from bullish to bearish, 4 analysts have published ratings on Zoetis ZTS in the last three months.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

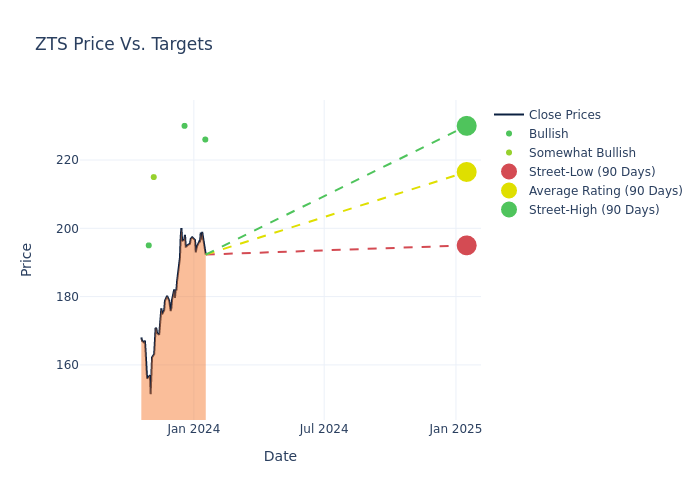

The 12-month price targets, analyzed by analysts, offer insights with an average target of $216.5, a high estimate of $230.00, and a low estimate of $195.00. Observing a 7.35% increase, the current average has risen from the previous average price target of $201.67.

Investigating Analyst Ratings: An Elaborate Study

A comprehensive examination of how financial experts perceive Zoetis is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Nathan Rich | Goldman Sachs | Raises | Buy | $226.00 | $190.00 |

| Glen Santangelo | Jefferies | Announces | Buy | $230.00 | - |

| David Westenberg | Piper Sandler | Raises | Overweight | $215.00 | $210.00 |

| Jonathan Block | Stifel | Lowers | Buy | $195.00 | $205.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Zoetis. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Zoetis compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Zoetis's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Zoetis analyst ratings.

Unveiling the Story Behind Zoetis

Zoetis sells anti-infectives, vaccines, parasiticides, diagnostics, and other health products for animals. The firm earns roughly 35% of total revenue from production animals (cattle, pigs, poultry, and so on), and nearly 65% from companion animal (dogs, horses, cats) products. Its U.S. business is heavily skewed toward companion animals, while its international business is slightly skewed toward production animals. The firm has the largest market share in the industry and was previously Pfizer's animal health unit.

Financial Insights: Zoetis

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Zoetis's remarkable performance in 3 months is evident. As of 30 September, 2023, the company achieved an impressive revenue growth rate of 7.44%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Zoetis's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 27.71% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 12.28%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Zoetis's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.28% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Zoetis's debt-to-equity ratio stands notably higher than the industry average, reaching 1.33. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Analyst Ratings: What Are They?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.