In new report, Deutsche Bank analyst Michael Spencer discusses the recent market turmoil in China, how it compares to past crises in Asia and what traders can expect from China in the future.

According to Spencer, what the world has seen from China this year is nothing on the scale of what is has seen in the past, but things in China could get much worse before they get better.

Chinese Policy Decisions Driving Equity Markets

Spencer believes that the uncertainty surrounding China’s policy approach to its plummeting stock market and plummeting currency has been the key driver behind the wild swings in global equity markets over the past week. He sees no underlying shift in market fundamentals that would warrant such volatility.

Is This A Crisis?

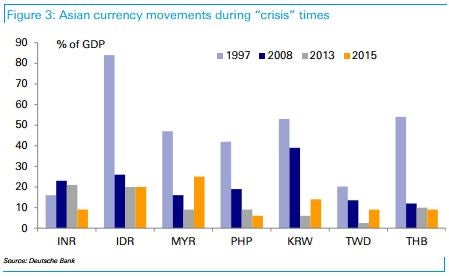

Although thigs have gotten bad in China in recent months, Spencer points out that there is no need to call this a “crisis” just yet. He argues that there is little evidence of systemic difficulties in Asian countries meeting external debt payments.

What’s To Come

Spencer believes that a decision by the Chinese government not to prop up equity prices would be commendable, and notes that the world has largely ignored previous booms and busts in the Chinese stock market.

“More worrying would be if the same laissez-faire attitude was applied to the currency,” he warns. Spencer believes that a significant further depreciation of the Renminbi would lead to depreciation across all of Asia and even the rest of the world.

“The exchange rate is the most important price in a small open economy, so if China – everyone’s competitor – devalues again (and that is not our expectation), it will likely have serious repercussions on currency values and asset prices everywhere,” Spencer writes.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.