High-flier NVIDIA Corporation NVDA may see its gravity defying upward momentum stall soon. It is one of the biggest gainers among the S&P 500 stocks in 2016, riding on the surging demand for graphics chips.

High-Flier Faces Risk Of Retreat

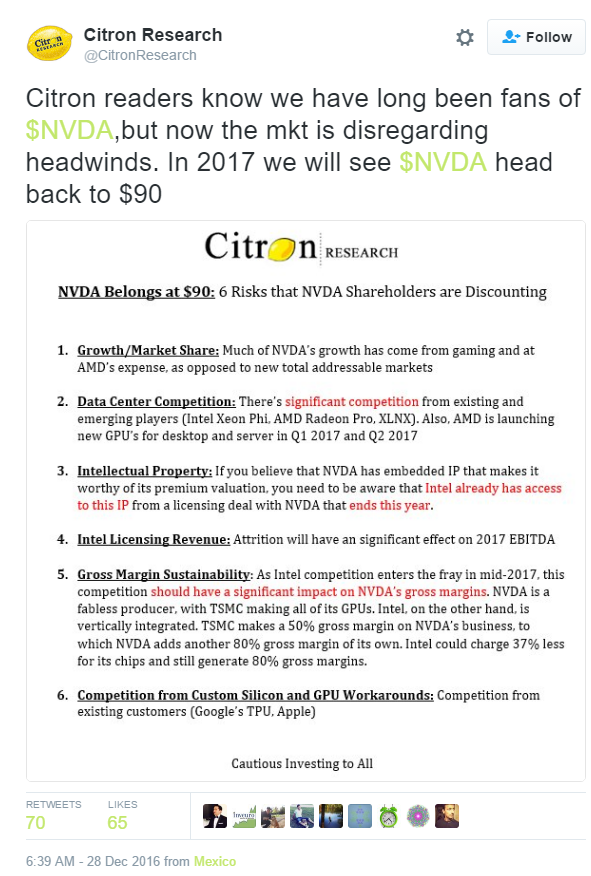

Citron Research said in a tweet that NVIDIA may be heading back to $90 in 2017, as the market is currently disregarding headwinds. After over a 255 percent gain in 2016, the stock closed Tuesday's session at $117.32. The target Citron is having for 2017 suggests a downside of about 23 percent from current levels.

This is in contrast to views of some Wall Street analysts, who see the rally continuing into 2017.

6 Risks

Citron listed six risks the markets are currently discounting and that could have a bearing on the company's stock heading into 2017:

- NVIDIA's growth has come mainly from gaming and at the expense of Advanced Micro Devices, Inc. AMD. The company hasn't managed to grow its new total addressable markets.

- Citron sees competitive threat from Intel Corporation INTC, AMD and Xilinx, Inc. XLNX in the data center market (from Intel's Xeon, AMD's Radeon Pro etc.). Additionally, the firm believes AMD's new GPUs for desktop and server is due in the first quarter and second quarter of 2017, respectively.

- The embedded intellectual property that just NVIDIA's premium valuation may not be the prerogative of the company alone, as Intel has access to this IP from a licensing deal with NVIDIA that ends this year.

- Citron believes Intel licensing revenue attrition will have a significant effect on NVIDIA's 2017 EBITDA.

- Citron also sees competition from custom silicon and GPU workarounds from existing customers such as Alphabet Inc GOOG GOOGL Google's TPU and Apple Inc. AAPL.

- The firm sees significant pressure for NVIDIA's gross margins, as Intel enters the fray in mid-2017. As opposed to Intel, which is vertically integrated, NVIDIA is a fabless producer, with Taiwan Semiconductor Mfg. Co. Ltd. (ADR) TSM making all of its GPUs. Intel can charge 37 percent less for its chips and still generate 80 percent gross margins.

At the time of writing, NVIDIA was slipping 3.64 percent to $113.05.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.