While Ulta Beauty Inc ULTA's stock has been tumbling amid Amazon.com, Inc. AMZN's fears, that did not stop Goldman Sachs analyst Matthew Fassler from upgrading Ulta to Buy with a $310 price target. He also added Ulta to Goldman’s Conviction List.

“We are positive after Ulta’s recent sell-off, as we see share gains and sector leading SSS growth continuing. We believe concerns driving the recent decline — i.e., heightened department store promotional activity and AMZN risk – are unlikely to express themselves in Ulta’s results in the near term,” Fassler wrote. “We do not believe price competition will derail ULTA's core value proposition, or that Amazon yet offers a compelling alternative to the consumer.”

Why Is Fassler Bullish On Ulta?

Fassler expects Ulta to keep doing what it has been doing, and to see some new growth initiatives. “Our thesis on Ulta has always been predicated on location (convenient), assortment (mass + prestige), and service (low-pressure vs. commission), not on price. We expect continued share gains, reflecting incremental sales captured from department stores, upside from the rollout of new brands and boutiques, and growth in ULTA's membership program, also a powerful source of valuable data.”

Overall, he sees Amazon as a competitor to Ulta, but not a huge threat.

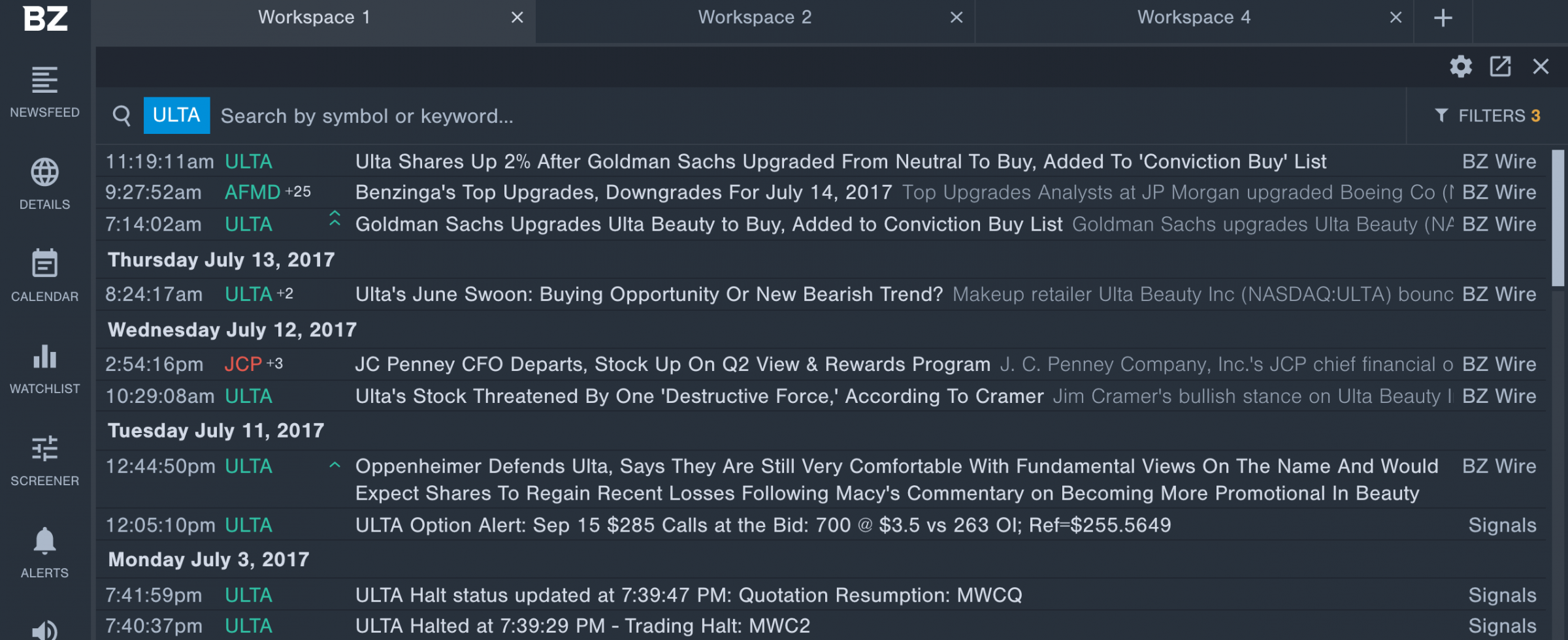

Ulta shares were up 2.2 percent during Friday’s trading session. To read the latest and exclusive financial news and analyst updates, check out the Benzinga Pro news wire.

Related Links:Ulta's Stock Threatened By One 'Destructive Force,' According To Cramer

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.