Emerging market stocks have taken a beating in 2018 thanks to the international trade war. If history is any indication, long-term investors shouldn’t sweat this year’s pullback.

Earlier this month, the MSCI Emerging Markets Index dropped 20 percent below its January peak, crossing the technical threshold into bear market territory. While a 20-percent drop is certainly not ideal for investors, it may not be as scary as it seems.

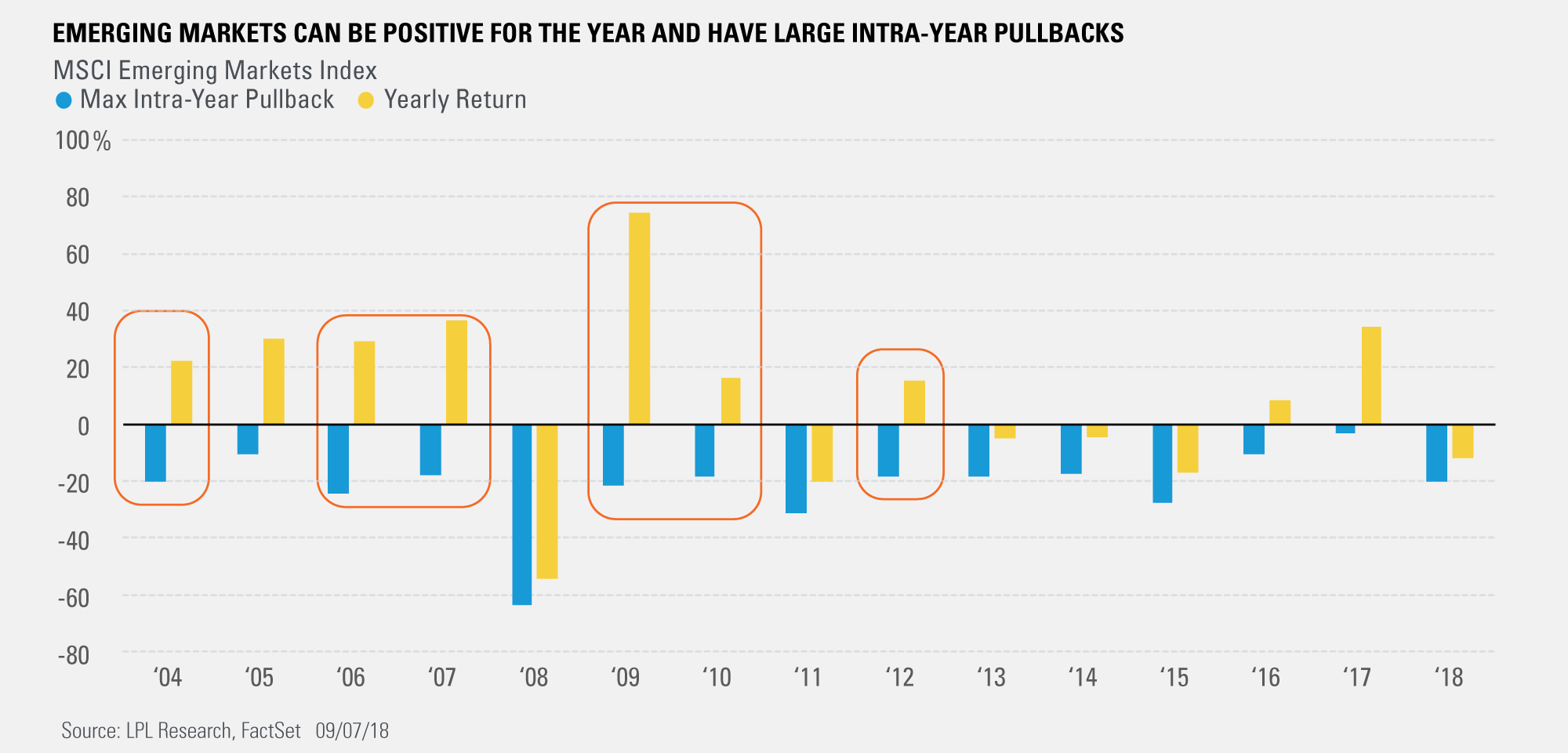

“Going back 15 years, we found that 11 times that EM pulled back at least 15 percent at some point during the calendar year and in six of those times, EM stocks actually gained on the year,” LPL Financial strategist Ryan Detrick recently said.

The chart below shows how emerging market stocks tend to bounce back following intra-year pullbacks. In fact, 2008 is the only time in the past 15 years emerging market stocks dropped more than 20 percent in a single calendar year.

Infographic courtesy of LPL Research.

Some emerging markets analysts see the dip as a major buying opportunity. Oppenheimer Developing Markets fund manager Justin Leverenz recently said investors shouldn’t let the trade war headlines scare them away from investing in solid emerging market companies.

“When the world is looking at the headlines, we look at the companies we own or want to invest in and try to understand them better,” Leverenz said.

Year-to-date, the iShares MSCI Emerging Markets Indx EEM has dropped 8.8 percent, almost the perfect inverse of the 9-percent gain in the SPDR S&P 500 ETF Trust SPY.

Related Links:

US, China Announce New Tariffs: Wall Street Reacts

Trump's Bailout For Farmers Caught In The Trade War: What You Need To Know

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.