This year has been a year of firsts on Wall Street, and the options market is the latest to register an unprecedented surge in popularity.

Goldman Sachs has reported that single stock options trading volume has surpassed the daily trading volume of the underlying stocks for the first time in history.

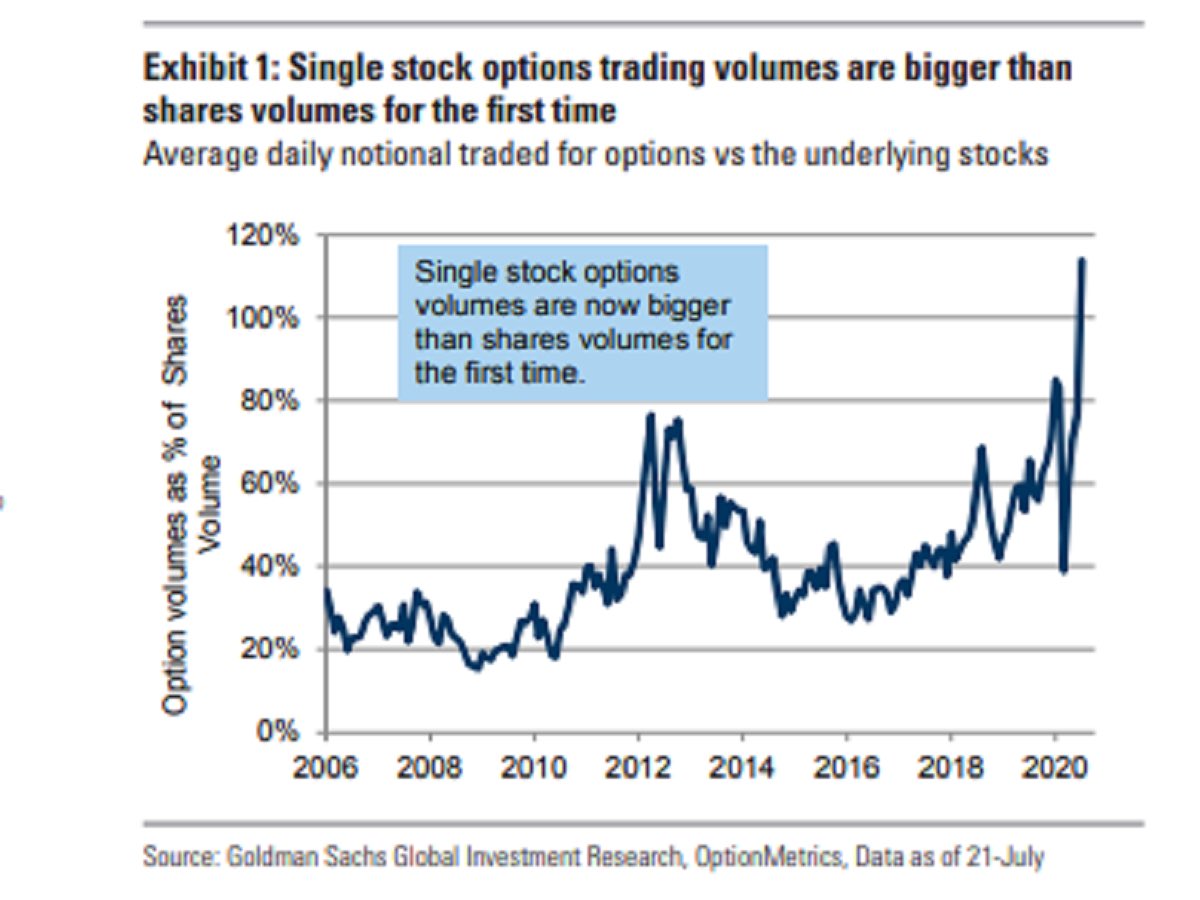

Option Trading Spike: The graph below shows just how much option volume has skyrocketed relative to stock trading volume in 2020, and some market experts are concerned about how a flood of younger, inexperienced and risk-hungry traders may be impacting the market.

With many Americans stuck at home for extended periods of time due to lockdowns, major sports and other events canceled and casinos closed, the number of retail stock traders has skyrocketed in 2020. Popular trading app Robinhood reported 3 million new accounts in the first quarter alone. Robinhood users reportedly have an average age of 31, and the company has said half of its users have never invested before.

See Also: Option Signal Alerts To Grow Your Trading Account

Some of the most popular stocks on the Robinhood app are names like American Airlines Group Inc AAL, Tesla Inc TSLA and Carnival Corp CCL, extremely volatile and high-risk stocks that each have less than 30% "Buy" ratings among Wall Street analysts.

But some young traders appear to be taking the risk to the next level by venturing into the complicated world of leveraged option trading. Twenty-year-old Alex Kearns made headlines when he took his own life after racking up what he believed to be $750,000 in losses in his Robinhood account from option trading.

In his suicide note, Kearns told his family he had “no clue what I was doing now in hindsight.”

Option Market Gamblers: As of late June, a record 28 million option contracts have been traded daily in 2020, up 45% from a year ago, according to Options Clearing Corp. Among the 50 most-traded stocks, Goldman Sachs research found the percentage of option contract trades that represent extremely small orders of only a single contract has risen from 10% last year to 14% in 2020.

For market gamblers, the appeal of option contracts is obvious. Option buyers can essentially bet on 100 shares of stock for a small fraction of the cost of those underlying shares. A relatively small move in the underlying stock can produce huge swings in the value of its option contracts due to this leverage.

Combine this massive potential option leverage with the fact that studies have consistently shown upwards of 90% of new day traders lose money in the market, and it’s understandable why Wall Street veterans are getting nervous about the spike in options trading activity this year.

Benzinga’s Take: New investors should understand the difference between investing to make money in the long-term and day trading stocks and options contracts to gamble. Studies have repeatedly shown that long-term, diversified investing for time horizons of 10 years or longer is almost always a profitable endeavor, whereas day trading is a losing strategy for at least 90% of new traders.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.