Netflix Inc. NFLX shares traded higher Tuesday after Argus Research upgraded the streaming stock from Hold to Buy and announced a $650 price target.

Netflix gained 2.29% Tuesday, closing at $535.09.

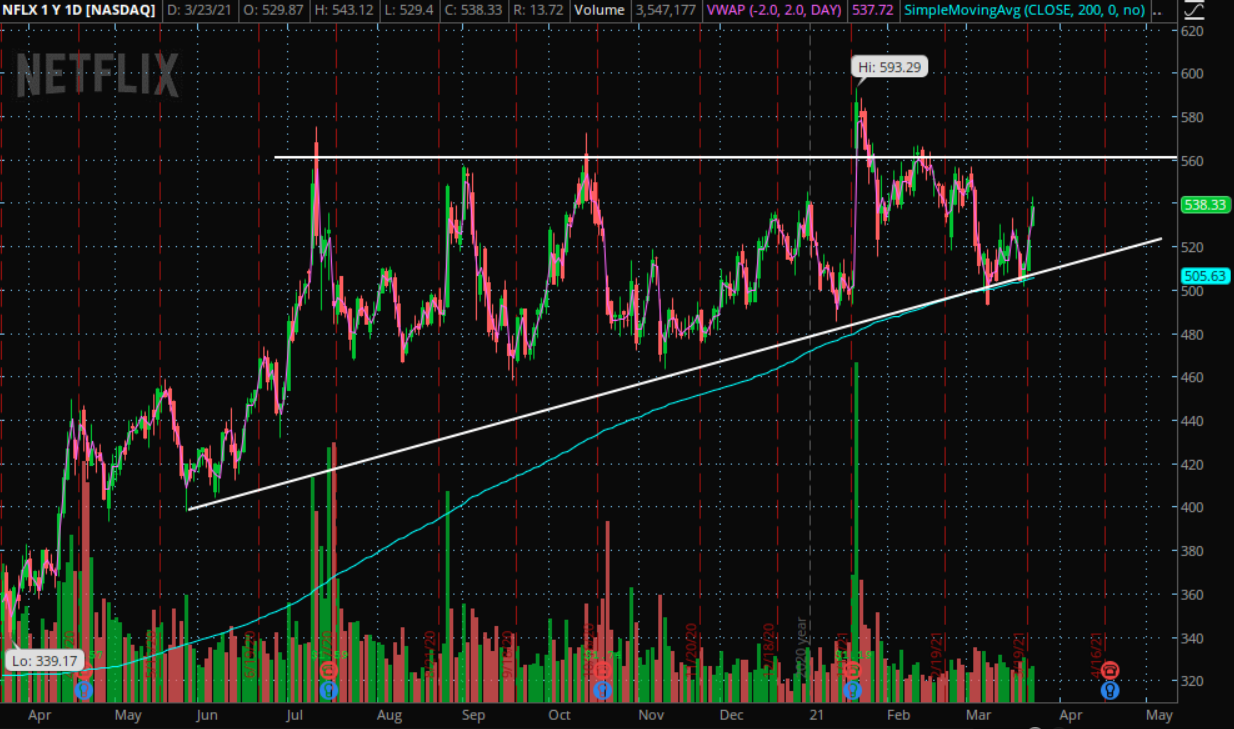

Netflix Chart Analysis: Shown above is the daily chart for Netflix stock. The chart looks to be forming what technical traders may call an “ascending triangle” pattern.

An ascending triangle pattern occurs when the stock builds higher lows up to a certain price level of resistance before breaking out and moving higher. Although the pattern is considered bullish, take caution, as the patterns don’t work every time.

The stock has struggled to cross above the $560 level, and this level has acted as resistance for the stock before. It is possible the level will hold as resistance here in the future.

The stock has been building higher lows throughout the last year. This can be shown by connecting all of the lows on the chart with a line. This line has a positive slope building up to the resistance level.

The stock is trading above both the 200-day moving average (blue) and the volume-weighted average price (pink), indicating the stock has bullish sentiment. These indicators may hold as support in the future.

Bulls would like to see the stock break above the resistance level, consolidate for a period while retesting the resistance level as a support level before an upwards move may happen.

Bears would like to see the stock test the resistance level, fail to break out and stop forming higher lows before it may have a stronger bearish move.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.