Tilray Inc TLRY shot up over 25% on Wednesday following the release of the cannabis giant’s record fourth-quarter 2021 results and a bullish conference call where CEO Irwin Simon projected 2024 revenues of $4 billion. The stock made most of its gains in the first half-hour of the trading session, gapping up 11% and running another 11% higher by 10 a.m.

What Happened: Cantor Fitzgerald analyst Pablo Zuanic watched the move and issued a note in which he attributed Tilray’s price action to a short-squeeze and stated there was “too much noise to make a big deal about the qtr.” Zuanic complained that no pro forma sales numbers by division were included for the quarter, despite being included for previous quarters, and emphasized that Simon’s $4 billion revenue estimate is six times current levels.

Simon joined Javier Hasse and Patrick Lane on Wednesday’s "Cannabis Hour" to discuss Tilray’s quarter and his plan to grow the company. “I put a plan out there for $4 billion dollars by 2021. Some people might think I’m crazy or aspirational or whatever,” Simon said. He then went on to list how Tilray can increase its revenues to that level. He believes:

More and more consumers are going to buy cannabis

U.S. legalization will happen

Tilray will have a good footprint in the U.S.

Tilray will complete acquisitions within its food and beer business.

Click here to listen to Irwin Simon, CEO of Tilray ($TLRY) Interview on Benzinga Cannabis Hour Podcast.

See Also: EXCLUSIVE: Tilray CEO Irwin Simon Discusses Earnings Report, Stock Surge On Benzinga Cannabis Hour

Why It Matters: There was reason for investors to become excited by Tilray’s earnings print and buy the stock, which may have caused those who were holding a short position to cover. The number of shares held short on Tilray’s stock has increased slightly from June. Of Tilray’s 427.93 million share float 31.86 million shares are held short compared to 29.7 in June. This is down from May when 34.81 million shares were held short but up massively from 22.25 in April.

Zuanic's attempt to downplay Tilray’s bullish action as a short squeeze ignores the fact that for a short squeeze to happen traders and investors need to actively come in and buy the stock. And, Wednesday’s action certainly shows there were buyers.

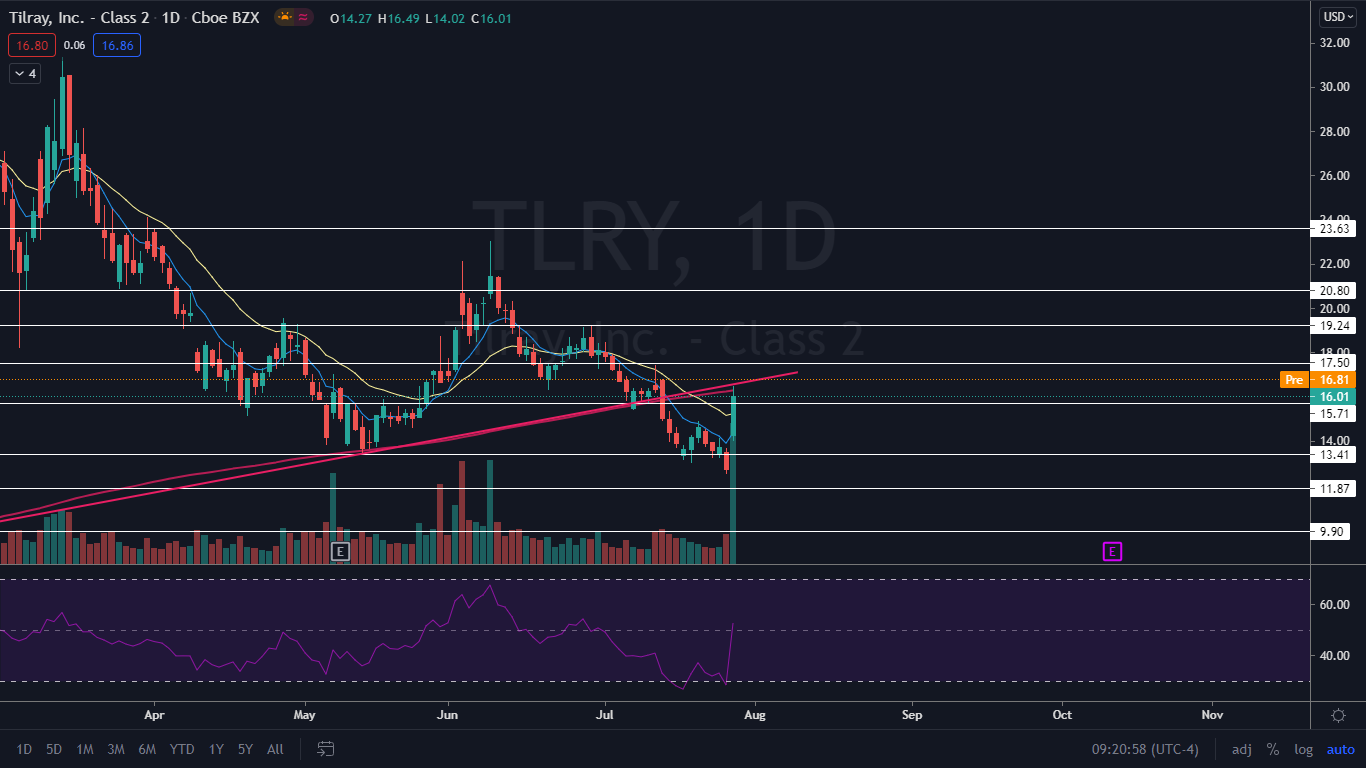

The Tilray Chart: In the premarket on Thursday Tilray’s stock popped up over the 200-day simple moving average (SMA). The 200-day SMA is an important indicator because it demonstrates whether overall sentiment in a stock is bullish or bearish. Tilray’s stock has been trading below the SMA and on Wednesday’s big bullish move the stock rejected and wicked from the level. If Tilray is able to regain the level and make the 200-day SMA support it will be a great sign for the bulls going forward.

Both bulls and bears will want to watch Thursday’s volume to see what direction is coming next. Continued big bullish volume to drive the stock up or low consolidation volume and sideways action is a good sign for the bulls. The bears want to see large exiting volume before considering a position.

After the 200-day SMA Tilray has resistance at $17.50, $19.24 and $20.80.

The stock has support below at $15.71, $13.41 and $11.87.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.