Cryptocurrency investment products recorded outflows for the second consecutive week, according to data collected by CoinShares.

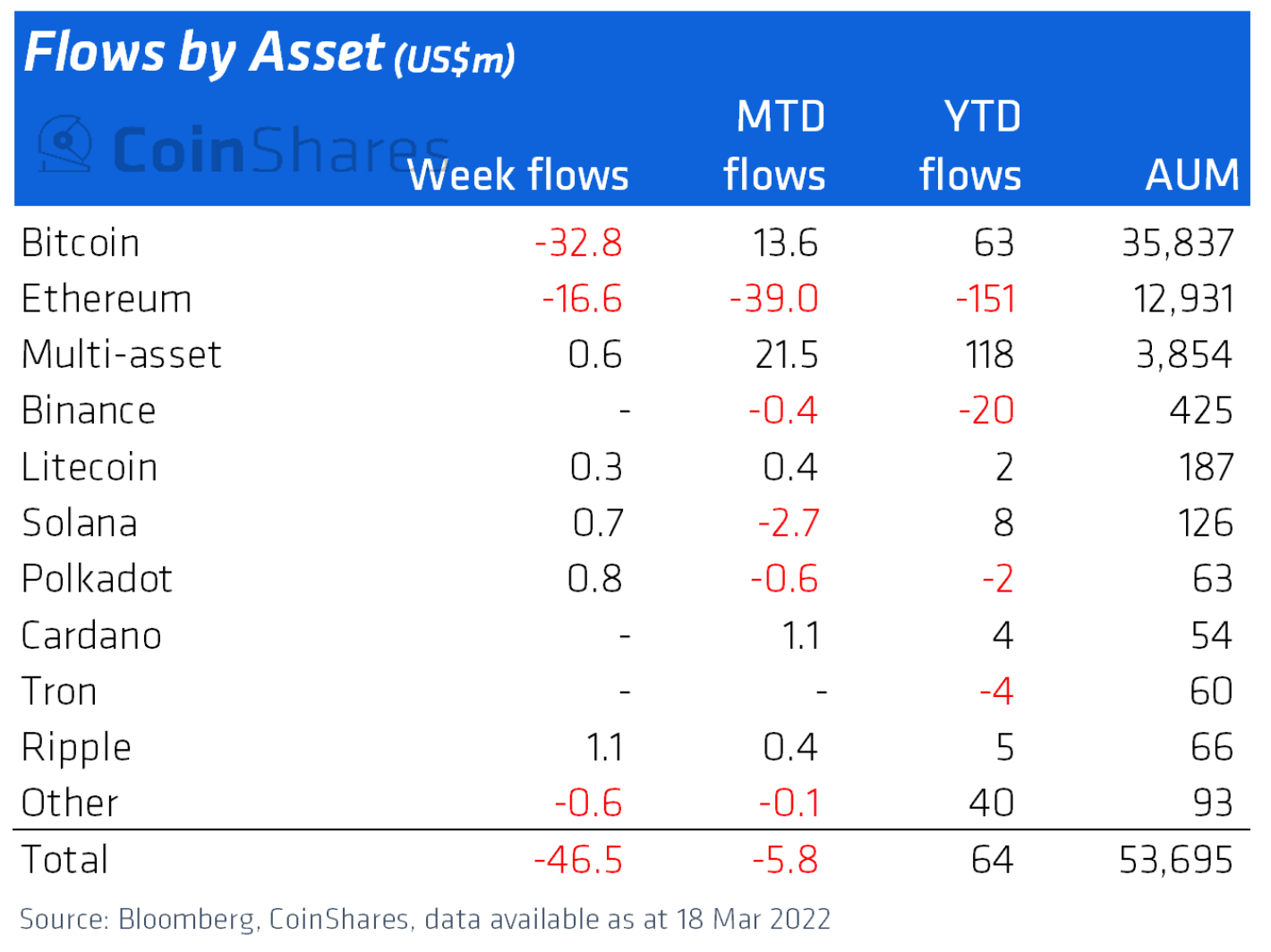

What Happened: Bitcoin BTC/USD saw $32.8 million worth of outflows for the week while Ethereum ETH/USD saw $16.6 million worth of outflows for the week ended March 18.

Altcoin-focused funds recorded moderate inflows over the week, bringing net outflows to $46.5 million.

Ripple XRP/USD, Polkadot DOT/USD, and Solana SOL/USD had inflows totaling $1.1 million, $800,000, and $700,000, respectively.

The bulk of outflows appears to have come from investors based in North America, whereas fund flows in Europe were broadly flat.

“We believe the recent negative sentiment in North America is due to continued jitters over regulation and geopolitical issues caused by the Ukrainian conflict,” stated CoinShares in the report.

Bitcoin was trading around $41,600 during Asian hours on Tuesday, gaining just 0.95% in the last 24 hours. Ethereum was trading at $2,900, up 2.12% over the same period.

“Crypto traders should be impressed that Bitcoin is still hovering around the $40,000 level despite a surging dollar, declining Bitcoin mining, and falling NFT interest,” said Edward Moya, a senior market analyst with OANDA, in a note seen by Benzinga on Monday.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.