Zinger Key Points

- The S&P 500 has historically underperformed in the second half of February.

- The strong labor market may remain a headwind for stock prices in the near term.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

The SPDR S&P 500 ETF Trust SPY is off to a strong start to 2023, but history suggests the second half of February could be a difficult road for the market.

After a difficult December and a horrible overall 2022, the stock market rallied in January as fears over inflation subsided. Investors are now optimistic the Federal Reserve can avoid a hard landing for the U.S. economy and could even be in a position to begin cutting interest rates sooner than expected.

Related Link: U.S. Consumer Sentiment Jumps 5.7% In February: What It Means For The Markets

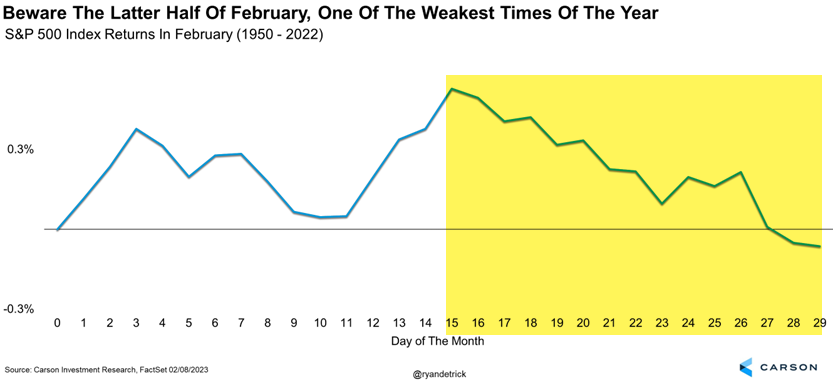

Historically Bad: Unfortunately, Carson Group’s Ryan Detrick tweeted the chart below on Thursday, highlighting the S&P 500's seasonal struggles starting on Feb. 15.

"The second half of February historically can be troublesome for stocks. After the great start to this year, some typical seasonal weakness wouldn't be all that surprising," Detrick said.

Earlier this week, Brad McMillan, chief investment officer for Commonwealth Financial Network, said the blowout January jobs report suggests the labor market may remain a headwind for stock prices in the near term.

"While it appears that inflation will keep dropping, the shockingly strong jobs report at the start of February put the Fed back on edge, and it will likely push rates higher than we thought. This will be a headwind for markets this month, as the decline in rates may pause or even reverse," McMillan said.

Related Link: Analyst Says Be Careful With Big Tech Stocks: 'Nothing In This Space Is Cheap Anymore'

Benzinga's Take: The good news is any market weakness in the second half of February could be a longer-term buying opportunity.

The six-month stretch from November to April starting in a midterm election year has generated a positive S&P 500 return each time since 1950 and produced an average gain of about 15%.

Photo: PeskyMonkey via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.