Zinger Key Points

- Intel's Q3 earnings report is eagerly anticipated as it faces semiconductor industry challenges and stock price turbulence.

- Goldman Sachs maintains a "Sell" rating, citing concerns over Intel's market share and uncertainty about IDM 2.0 impact.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

In the heart of Silicon Valley, all eyes are on Intel Corp. INTC as it gears up to unveil its third-quarter earnings report on Thursday after the closing bell.

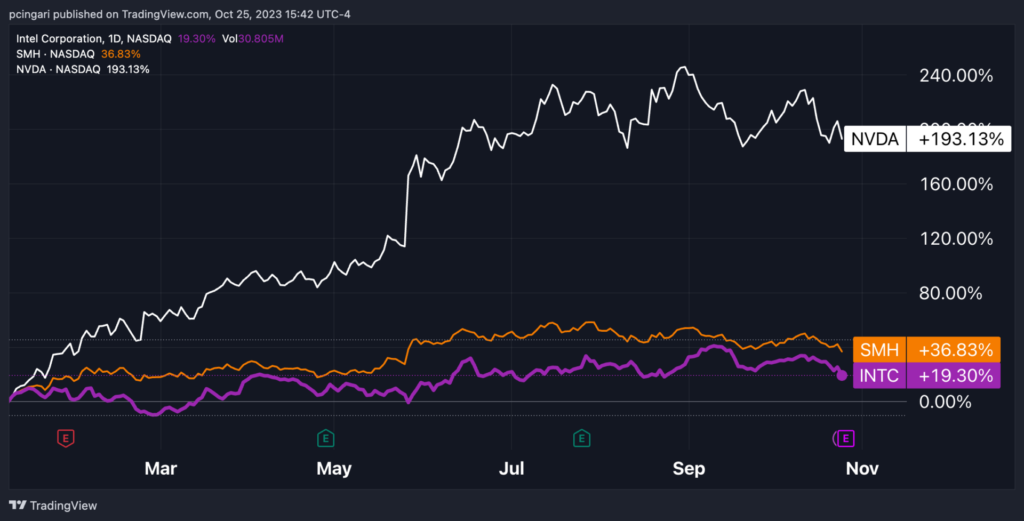

For the Santa-Clara-based company, this report carries substantial importance, as it grapples with a shifting semiconductor landscape that has seen its shares underperform against the likes of Nvidia Corp. NVDA and the broader microchip industry throughout the year.

Chart: Intel Has Underperformed Nvidia And The VanEck Semiconductor ETF SMH Year To Date

Intel Q3 Earnings Preview: What Are Analysts Expecting?

The Street’s consensus pins earnings per share at $0.22, with revenue estimates standing at $13.57 billion.

A stark contrast from the same quarter last year, net profits are projected to plummet by a staggering 73%, with overall revenue expected to take an 11% hit.

In the past four quarters, Intel delivered better-than-expected results in both Q1 and Q2 this year, as well as in Q3 2022, only sharply missing the Street’s estimates in Q4 2022.

Goldman Sachs Is Bearish Vs. Consensus

Goldman Sachs’ analysts are sounding a cautionary note. They highlight a negative read-across for Intel, citing concerns that the increasing availability of ARM-based CPUs to PC Original Equipment Manufacturers (OEMs) could eat into Intel’s market share.

Intel, which held a commanding 72% market share in PC CPUs in 2022, according to Mercury, is anticipated to derive 54% of its total revenue from the Client business in 2023.

The unresolved question that looms over Intel relates to the progress of its Intel Foundry Services (IFS). Investors are eagerly awaiting updates on whether Intel can make significant strides in this critical area.

Goldman Sachs is maintaining a Sell rating on Intel, primarily due to the lingering uncertainty surrounding IDM 2.0 (Intel’s manufacturing technology) and its potential impact on the company’s financial profile.

The 12-month price target from Goldman Sachs is $28.00, suggesting a potential 15% decline from current levels.

The average 1-year Wall Street’s consensus price target on Intel is currently $36, or 10% above current market prices.

On the eve of the earnings release, Intel’s stock experienced a sharp downturn. Shares were down by 5% on Wednesday, marking their lowest point in two months. This drop represented Intel’s worst-performing session since June 21.

Read now: Japan’s Semiconductor Push Aims to Bolster Nvidia’s Key Supplier TSMC With $10B Subsidy

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.