Zinger Key Points

- AMD attributes strong Q3 to Ryzen 7000 series PC processors and record server processor sales.

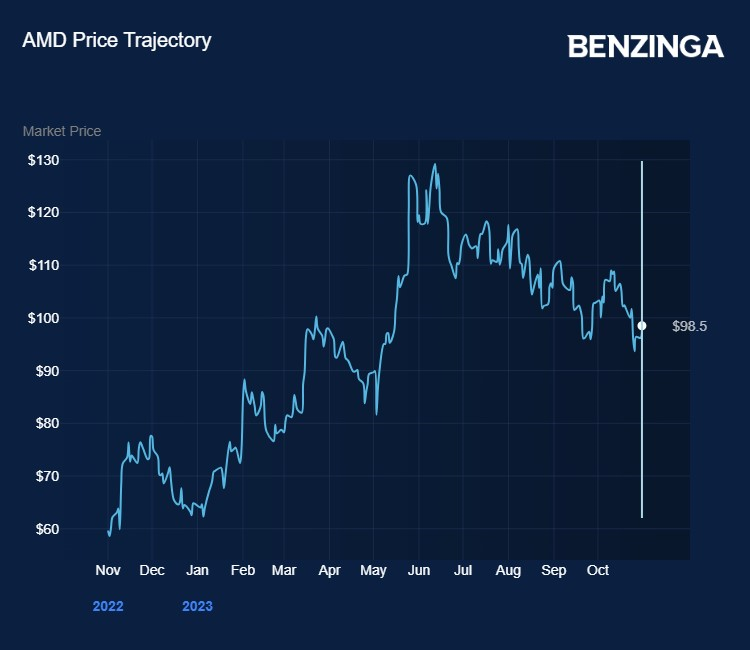

- AMD shares have outperformed the broader market and the semiconductor sector in the year-to-date period.

- The new Benzinga Rankings show you exactly how stocks stack up—scoring them across five key factors that matter most to investors. Every day, one stock rises to the top. Which one is leading today?

Chipmaker Advanced Micro Devices, Inc. AMD reported Tuesday after the market close third-quarter earnings and revenue that came in ahead of expectations. Strong PC and server processor sales led to the outperformance. AMD CEO hinted at a strong ramp of Instinct MI300 accelerator shipments.

The guidance for the fourth quarter was roughly in line with estimates, sending the stock lower in after-hours trading.

AMD’s Key Q3 Numbers

AMD reported third-quarter non-GAAP earnings per shar, or EPS, of 70 cents per, up 4 % from the year-ago earnings per share of 67 cents. The bottom-line climbed 21% from second-quarter’s $0.58 per share.

Analysts, on average, had modeled EPS, of 64 cents for the quarter.

The Santa Clara, California-based company grew it revenue 4% year-over-year from $5.62 billion in the third quarter of 2022 to $5.8 billion in the third quarter of 2023. It also topped the consensus estimate of $5.27 billion. Sequentially, the top line grew 8% from $5.36 billion in the second quarter.

In early August, AMD guided third-quarter revenue to be approximately $5.7 billion, plus or minus $300 million. The company penciled in non-GAAP gross margin at about 51% compared to the previous quarter’s 50% and year-ago’s 54%.

KeyBanc Capital Markets analyst John Vinh had modeling in line with slightly higher results, premised on improving PC demand and troughing server demand, along with normalizing Milan server processor chip inventory at Cloud Service providers. Raymond James’ Srini Pajjuri called for a slight third-quarter upside based on his view that PC tracked slightly better, and the Data Center tracked in line.

Rival Intel Corp. INTC last week reported EPS and revenue of 41 cents and $14.16 billion, respectively, ahead of the consensus estimates of 22 cents and $13.57 billion, respectively.

AMD’s non-GAAP gross margin came in at 51%, in line with the guidance. This compares favorably to the previous quarter’s 50%.

“We delivered strong revenue and earnings growth driven by demand for our Ryzen 7000 series PC processors and record server processor sales," said Su.

"Our data center business is on a significant growth trajectory based on the strength of our EPYC CPU portfolio and the ramp of Instinct MI300 accelerator shipments to support multiple deployments with hyperscale, enterprise and AI customers,” she added.

See Also: Best Semiconductor Stocks

How AMD’s How AMD's Businesses Fared

PC processor sales rose strongly, with the Client segment revenue surging a better-than-expected 42% year-over-year and surged up 46% sequentially to $1.5 billion. Ahead of the results, RayJay’s Pajjuri said, “We believe that the worst is now behind and expect AMD to benefit from inventory normalization,” he added.

The Data Center segment came in at $1.6 billion, flat year-over-year, as the company's fourth-generation EPYC server processor sales growth was offset by a decline in sales of SoC data center products. Sequentially, revenue rose 21%

On the other hand, Gaming segment’s revenue fell 8% year-over-year and was down 5% sequentially to $1.5 billion due to a decline in semicustom revenue. Embedded segment revenue, derived primarily from Xilinx unit, came in at $1.2 billion, down 5% year-over-year and 15% sequentially due to revenue decline from the communications market.

AMD’s Q4 Outlook

AMD guided to fourth-quarter revenue of $6.1 billion plus or minus $300 million. The current consensus estimates call for revenue of $6.01 billion. At the mid-point, this represents year-over-year growth of approximately 9% and sequential growth of approximately 5%, the company said.

Analysts are guarded. KeyBanc’s Vinh said he sees moderate risk to the fourth-quarter guidance, given his view that there could be some volume pushout of MI300A at HP/El Capitan. But he expects the ramp-up to happen in the fourth quarter. The analyst also noted signs of a more moderate ramp-up of Genoa, as some customers have pushed out the timing of their ramps.

RayJay models modest revenue from MI300X GPU in the fourth quarter and a gradual ramp through 2024.

The company sees fourth-quarter non-GAAP gross margin at 51.1%.

CFO Jean Hu said, “In the fourth quarter, we expect to see strong growth in Data Center and continued momentum in Client, partially offset by lower sales in the Gaming segment and additional softening of demand in the embedded markets."

AMD, which trails the frontrunners in the AI race, announced its in-house AI accelerated processing units, MI300X and the more advanced MI300A, earlier this year. The company is expected to begin shipments of these AI accelerators this year, paving the way for reaping the AI windfall in the upcoming year.

The stock has gained about 52% year-to-date, outperforming the S&P 500’s and Nasdaq-100′s gains of 9.2% and 29.6%, respectively. The iShares Semiconductor ETF SOXX has risen 28.1% in the same timeframe.

The average rating for the stock is a Strong Buy, and the average consensus price target is $136.18, according to data from TipRanks.

AMD shares, which closed Tuesday’s regular session up 2,41% at $98.50, shed 4.06% to $94.36 in after-hours trading, according to Benzinga Pro data.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.