Zinger Key Points

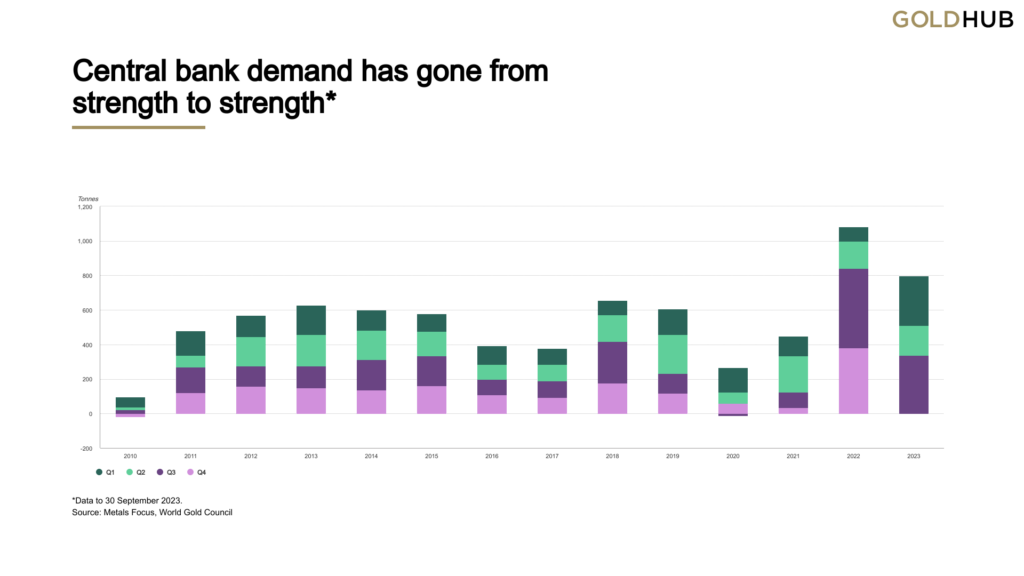

- Central banks globally are increasing their gold purchases significantly, on track for a record year.

- In contrast, jewelry demand is down 2% year-over-year due to high gold prices, with concerns about the upcoming India's wedding season.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

The global gold market is experiencing a seismic shift as it grapples with the sensitive $2,000 per ounce threshold.

A recent report from the World Gold Council reveals a significant change in buyer behavior, primarily driven by central banks’ actions and jewelry demand.

For a clearer view, it’s worth noting that central banks have increased their net purchases of gold by 14% compared to 2022, whereas the demand for jewelry has dipped by 2%. Concerns arise about further declines in jewelry consumption, especially as the Indian wedding season coincides with gold remaining at these elevated price levels.

Chart: Gold Hit $2,000/oz This Month, Drawing Haven Flows Amid Middle East War

Central Banks On Track For A Record Year In Gold Purchases

Central banks worldwide have been making historic purchases of gold, maintaining a remarkable pace during the last quarter.

According to the World Gold Council report, these institutions are on track for another “colossal year of buying.”

Central banks have bought an astonishing net total of 800 tons of gold so far in 2023. This represents a record high for the first nine months of the year.

In the latest quarter, central banks acquired a net total of 337 tons of gold, marking the third-strongest quarter in history. Although it fell short of the exceptional 459 tons recorded in Q3 2022, it’s noteworthy that sales remained notably low during this period.

The People’s Bank of China (PBoC) has once again emerged as the world’s foremost buyer of gold. In the last quarter, they increased their gold reserves by 78 tons. Notably, Poland and Singapore also made substantial contributions to this upward trend.

The rise in gold purchases by central banks reflects the growing importance of gold as a safe-haven asset, especially amid global monetary tightening and rising geopolitical uncertainties.

High Prices Have Adverse Impact on Jewelry Demand

As central banks continue to amass gold reserves, the demand for gold jewelry has faced challenges stemming from soaring prices.

The global consumption of gold jewelry witnessed an 8% uptick in the last quarter. However, when compared year-over-year, demand registered a 2% decline. This dip can be attributed to the escalating gold prices, which set new records in certain markets due to fluctuations in currency values.

Many consumers exercised caution, when considering the purchase of gold jewelry, stemming from concerns regarding a potential correction in gold prices in the future.

The SPDR Gold Trust GLD rose 7.3% this month, marking its best-performing month since March.

The World Gold Council has sounded a cautionary note, highlighting ongoing economic uncertainties in various markets and the sustained challenges posed by the cost of living crisis, both of which continue to exert pressure on consumers.

Near-record gold prices could potentially suppress demand in India, the world’s second-largest gold buyer, during the upcoming peak festival season, potentially leading to the lowest purchase volumes seen in three years.

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.