Zinger Key Points

- Bank of America predicts S&P 500 will reach 5,000 by end of 2024, a 10% increase from current levels.

- Shifts focus from 'Magnificent 7' to cyclicals, expects consumer-led growth, and interest rate cuts starting June 2024.

Bank of America has set an optimistic target for the S&P 500, forecasting a milestone of 5,000 points by the end of 2024. This projection signals a robust 10% leap from the index’s current standings, as noted by equity analyst Savita Subramanian in a recent market outlook report.

In a Monday conference call, Subramanian shared that the institution is favoring cyclicals over the high-flying Magnificent 7, which includes tech giants such as Apple Inc. AAPL, Microsoft Corp. MSFT, Alphabet Inc. GOOG GOOGL, Amazon Inc. AMZN, Meta Platforms Inc. META, NVIDIA Corp. NVDA and Tesla, Inc. TSLA.

The shift indicates a broader market appeal, with the firm finding “other areas of the market incredibly attractive.”

The bank’s analysts are seeing signs of a maturing economic cycle, expecting a decrease in the equity risk premium as U.S. corporations streamline operations. Increased efficiency, coupled with advancements in automation, are set to drive productivity higher.

BofA’s Baseline Economic Scenario Is For A Soft Landing

Bank of America’s U.S. economist, Michael Gapen, anticipates a “soft landing” for the U.S. economy, with inflation descending towards the Federal Reserve’s 2% goal.

Gapen projects a consumer-led economic drive, supported by the “strong balance sheet of US consumers.” This consumption strength is expected to persist, even with a softer growth outlook.

Furthermore, Gapen forecasts that the Fed will initiate interest rate cuts in June 2024, adopting a cautious approach by reducing rates by 25 basis points per quarter into early 2026, navigating the post-Covid landscape of positive interest rates.

Why BofA Is Bullish On Cyclicals, Bearish On Tech

Subramanian stated that Bank of America holds an out-of-consensus view on U.S. stocks, depicting a rather bullish picture.

“We are bullish because of what the Fed has actually done in the last couple of years, and how corporates have adapted to high interest rates,” Subramanian stated in the call.

The analyst also touched on the transformative power of generative AI in propelling corporate efficiency. This, along with the shift towards automation, forms the new bedrock for earnings growth.

Addressing concerns regarding interest rates and refinancing, Subramanian said, “Corporates have locked in long-dated fixed-rate debt,” suggesting that the potential impact on earnings is both “known and manageable.”

Bank of America also views the geopolitical re-shoring of manufacturing and supply chains as a tailwind, with companies moving away from China towards more amicable trade partners like Canada and Mexico.

In terms of sector-specific guidance, Bank of America is overweighting Energy, Consumer Discretionary, Financials, and Real Estate, while adopting a cautious stance on Consumer Staples, Health Care, and Technology. The latter has been downgraded from market weight due to concerns over regulatory scrutiny, valuation, and crowding risks.

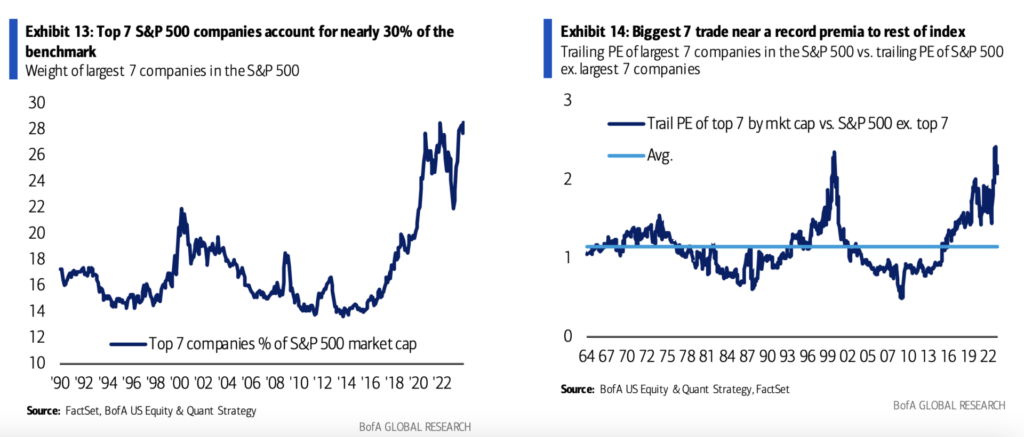

Bank of America showed that the 7 largest tech companies now account for nearly 30% of the S&P 500, and their price-to-earnings ratios are at extreme heights compared to the other stocks in the benchmark.

Chart: Bank of America

Read now: Cyber Monday Deals On Wall Street: 9 Tech Stocks Trading At 40%+ Discount from Analyst Expectations

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.