Zinger Key Points

- Morgan Stanley slashed its rating on Plug Power while maintaining its rating on Bloom Energy.

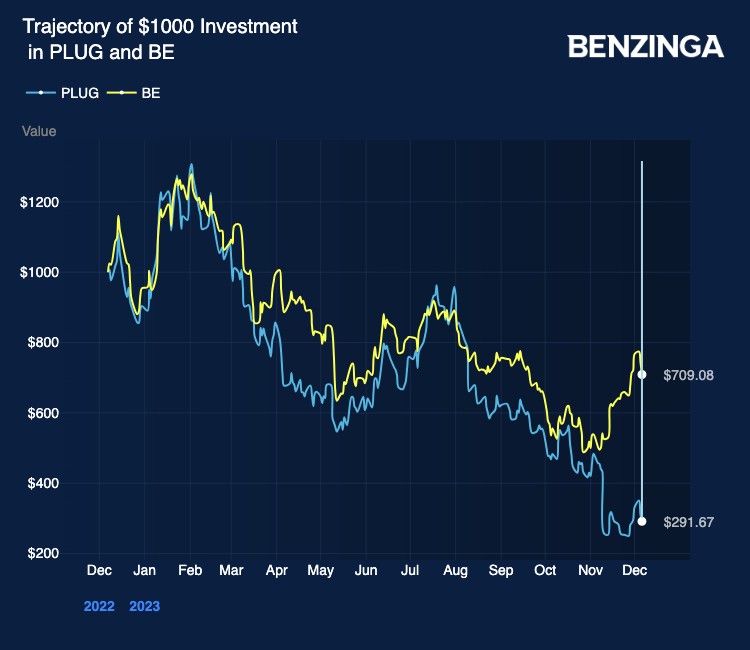

- Here's how a $1000 investment in each of these stocks would have fared over the past year.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Plug Power Inc PLUG stock has been on the decline over the past year. On Wednesday, Morgan Stanley slashed its rating to Underweight from Equal Weight with a $3 price target, cut from $3.50, citing “liquidity concerns and worsening hydrogen economics“.

Read: Plug Power ‘Plagued’ But A Rival Hydrogen OEM Stock Shows Promise – Morgan Stanley

In the same note, Morgan Stanley said it remains Overweight on Bloom Energy Corp BE given “strong underlying demand and the profitability of its fuel cell business.”

We compare the two clean energy companies here.

Related: Plug Power Down Over 37%, Issues Going Concern Warning — 4 Analysts Slash Stock Outlooks

A $1000 invested into each of these stocks a year back would have reduced in value. While the Bloom Energy stock investment would have reduced to $709.08, Plug Power stockholders would have been left with just $291.67 on their $1000 invested.

While both companies face challenges, one is in a worse situation as compared to the other.

Plug faces certain policy changes, external funding needs, and internal business headwinds. It is not expected to become profitable before 2026. Also, the company continues to burn cash at an alarming rate, indicating a need for urgent cash raising.

Bloom Energy, on the other hand, is demonstrating margin expansion. Despite facing business challenges and potential missed expectations, the company expects positive operating margins for 2023. The company is also exposed to challenges in clean energy. However, Bloom Energy is effectively differentiating itself through its products. Its electrolyzers were included in four hydrogen hubs. The sales inquiry pipeline remains robust, with the data center end market being the strongest.

Read Next: Hydrogen’s Make-Or-Break Moment: Industry Awaits Key Treasury Decision On Tax Credits

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.