Zinger Key Points

- Solar energy stocks are coming under pressure as funding fears hit SunPower.

- Goldman Sachs still likes the sector, with upgrades for Sunnova and Canadian Solar.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

Solar power stocks were coming under selling pressure on Monday, although a couple of names managed gains after Goldman Sachs upgrades. But SunPower tumbled after warning it was in danger of collapse.

SunPower Corp SPWR shares shed 35% to $4 after the company warned that there were substantial doubts about its ability to continue after it breached terms of a financial covenant agreement and added it would need to raise additional capital.

Goldman Sachs downgraded the stock in a sectoral coverage note to its clients. Lowering its rating to Sell and its price target to $4, the firm said: “We downgrade SPWR to Sell as the company works through a tough backdrop of uncertain supply chain, financing and operational challenges.”

Also Read: Solar Energy Broke Records In 2023, Why Are Shares Tumbling?

Goldman Sachs Upgrades Nova And Canadian Solar

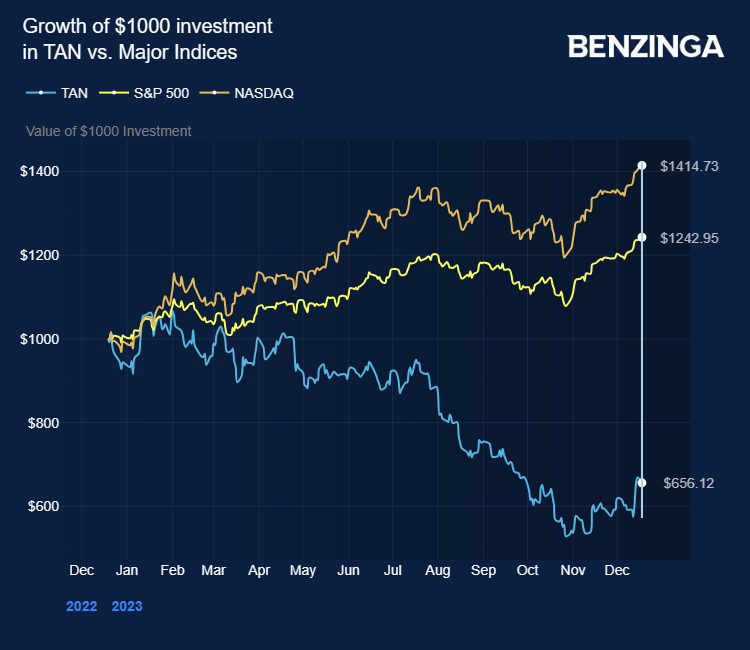

Goldman Sachs still likes the sector, however, saying it expected a recovery in residential sales — particularly in the U.S. market. And after substantial losses in the sector this year, with the Invesco Solar ETF TAN down around 35%, valuations are still below market price.

“We see a median of 55% upside potential to our Solar Coverage,” said analyst Brian Lee. “Our end market preference is still focused on utility-scale, while our geographical positioning also calls for more U.S. vs non-U.S. exposure.”

He added: “We also see the early stages of a U.S. resi recovery forming in 2024 and see reasons to be more constructive on this end market, albeit still somewhat selectively, and highlight this as the most incremental shift in our stock picking framework since a year ago.”

The broker raised Sunnova Energy International NOVA to a Buy with 65% potential upside to its $17 price target. Snares in NOVA, however, fell 3.1% to $13.41. Goldman also raised its rating on Canadian Solar CSIQ, from Sell to Neutral and the shares rose 2% to $24.69.

Other Moves

- Enphase Energy ENPH was up 0.6% to $124.63, after Goldman Sachs held its rating at Buy and suggested a potential 58% upside to its $158 price target. Lee says the company is “poised to benefit from a recovery in US resi solar fundamentals.”

- SolarEdge Technologies SEDG fell 3.4% to $93.86 after the broker cut its rating to Sell, saying “we believe a challenging backdrop in EU solar presents downside risk to consensus estimates in the near-to-medium term.”

- Sunrun RUN lost 3.8% to $17.94, despite Goldman retaining its Buy rating on the stock, while First Solar FSLR slid 1.7% to $165.75, after also maintaining a Buy rating.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.