Zinger Key Points

- BlackRock believes opportunities in AI space in 2024 lie beyond the 2023 high tiders - semiconductor and cloud.

- In 2024, investors may want to focus on stocks of AI data infrastructure and application providers.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

BlackRock‘s BLK Investment Institute’s 2024 Global Outlook highlights that AI opportunities in 2024 are expected to expand beyond 2023’s leading sectors, namely semiconductors and cloud computing.

The AI Technology Stack

2023 has emerged as a pivotal year for AI, particularly within the semiconductor and cloud segments of the technology sector. This technological advancement has propelled stocks like NVIDIA Corp NVDA, Advanced Micro Devices Inc. AMD, Alphabet Inc GOOG GOOGL, Microsoft Corp MSFT, and Broadcom Inc AVGO to new heights, positioning them at the forefront of the industry.

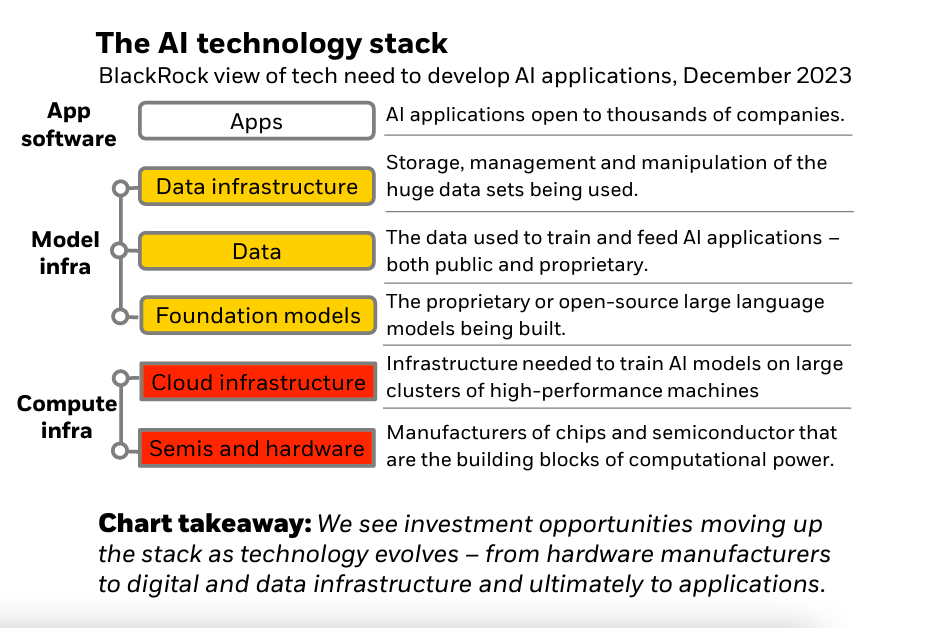

While BlackRock believes the advances in AI from here are likely to be “exponential,” the technology stack may offer a roadmap to assess investment opportunities.

According to BlackRock, there’s a shift occurring up the technology stack. While AI Compute infrastructure stocks have shown significant outperformance in 2023, the focus is now shifting to AI Model infrastructure. Following this trend, AI Application software stocks are poised to be the next growth drivers in the sector.

“We are somewhere between the first and second layers, with the last one likely coming next,” said the report.

AI Stocks Beyond Semiconductor & Cloud

Let’s explore some second-layer stocks, specifically those involved in offering data infrastructure and models [Based on Author’s research]:

- International Business Machines Corp IBM: IBM Watson Orchestrate specializes in automating tasks and workflows, so teams can redirect resources toward more pressing matters and boost their production. IBM recently acquired StreamSets and webMethods for $2.3 billion, boosting AI and hybrid cloud capabilities. The buyout is projected to add data ingestion capabilities to watsonx (IBM’s AI and data platform).

- Salesforce Inc CRM: Salesforce is one of the most well-known CRMs. The powerful tool lets companies log, manage and analyze customer data, information and activity. According to Salesforce Chief Data Officer Wendy Batchelder, "The AI revolution is actually a data revolution, and a company's AI strategy is only as strong as its data strategy, with trust at its core."

- Accenture PLC ACN: Accenture recently agreed to acquire Ammagamma, an Italy-based firm that helps companies enhance their uses of AI and generative AI technologies. The transaction is part of Accenture’s investment of $3 billion to accelerate clients’ transformation through large-scale application of AI.

- Kyndryl Holdings, Inc. KD: An IBM spin-off, Kyndryl is a provider of IT infrastructure services. Kyndryl has over three decades of experience in delivering secure data services and enterprise-grade AI. The company has forged strategic alliances with some of the biggest technology companies, including Microsoft and Amazon’s AWS for AI solutions. Kyndryl stock is garnering "increased" interest from 13F filers this year.

- From the AI App software realm, some key names that come to light include C3.ai Inc AI, Databricks, Alteryx, Dataminr, Scale AI, SparkCognition, LeewayHertz, DataRobot, Urbint and ThirdEye Data.

Overall, BlackRock is overweight the AI theme in developed market stocks on a six-to-12-month horizon. The institute identifies the tech sector's earnings resilience to be a major driver of overall U.S. corporate profit growth in 2024.

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.