Apple Inc. AAPL increased its market value by nearly $1 trillion this year. However, according to analysts, sustaining such significant gains in 2024 may prove challenging.

What Happened: As per a report by Bloomberg, Apple’s journey in China is getting tougher due to government crackdowns on foreign-produced devices. Increased competition from Huawei Technologies Co. and a potential U.S. ban on its smartwatch business also pose threats.

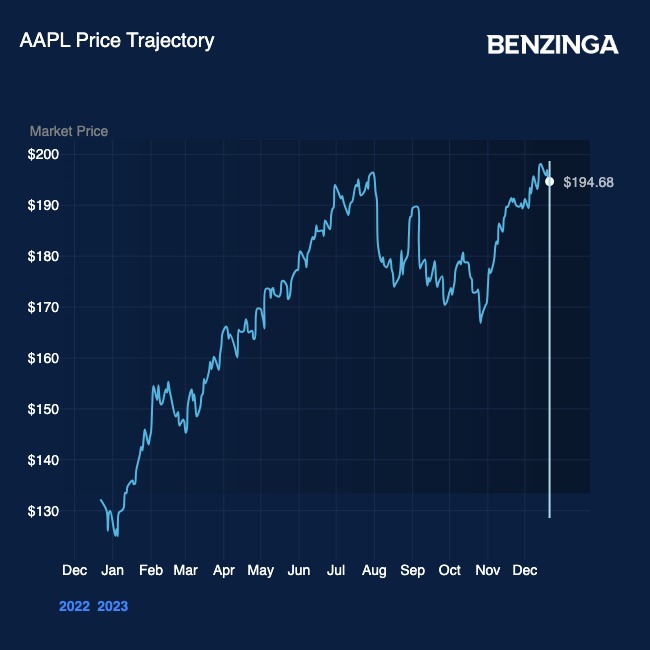

Despite these hurdles, Apple’s stock increased by 50% this year, primarily driven by investor faith in the company’s ability to sustain high profits. Its current valuation, 29 times next year’s predicted profits, is almost twice its 10-year average.

Eric Clark of Accuvest Global Advisors pointed out that the most significant risk for such mega-caps like Apple is the potential rotation of money to other names. He explained that such companies might face higher valuations, slower growth, and tougher year-over-year comparisons, encouraging investors to seek other areas with potentially higher returns.

See Also: Surging Trading In VIX Options May Suggest A Market Sentiment Shift

Investors are showing a preference for riskier stocks as interest rates reach their peak and inflation slows down. However, due to Apple’s stretched valuations, any increase in the stock would likely require a considerable rise in profits.

Despite a conservative outlook towards Apple, Daniel Ives, an analyst at Wedbush Securities, maintains a bullish stance, forecasting a $4 trillion market value for the stock by the end of next year.

Why It Matters: Apple’s journey to its current market valuation has been monumental. The tech giant became the first company to surpass a $3 trillion market capitalization mark at the beginning of 2022.

However, concerns arose over the price tag of the Vision Pro headset, leading to a brief pullback in Apple’s shares in mid-2023. The outlook quickly improved, and the stock reached new heights, partially due to broader market optimism and expectations of a pause in Federal Reserve rates in June.

Image Via Shutterstock

Engineered by Benzinga Neuro, Edited by Pooja Rajkumari

The GPT-4-based Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you. Learn more.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.